My Top Pick for more conservative investors in 2026 is the SPDR Portfolio Europe ETF (SPEU). I believe the odds are extremely high that Europe’s economy is going to continue to grow at a much higher rate than it had been growing prior to President Trump's shift in policy, says Nate Pile, editor of Nate’s Notes.

Trump has gone out of his way to let the rest of the free world know that America no longer intends to be the ally it used to be. So, other countries are not surprisingly starting to band together in a way that has not been seen (nor required on their part) in the post-World War II era.

Also not surprisingly, investors are starting to recognize that even a small shift in commerce away from the United States and towards (or within) Europe has the potential to result in significant growth for the European economy.

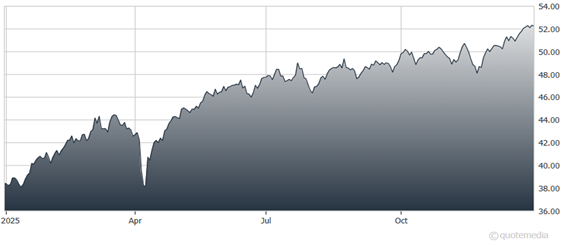

SPDR Portfolio Europe ETF (SPEU)

There are a number of different funds and ETFs that give investors exposure to the western European economy. But I chose this ETF for the simple reason that it provides a great deal of exposure to the region with a single purchase (roughly 1,800 companies are represented in the ETF). Plus, it is large enough that it provides plenty of liquidity for retail investors to get in and out of their positions with ease.

To be sure, an ETF like this is unlikely to generate the sorts of returns that can be achieved by owning individual stocks. But the diversification offered by the ETF is what makes it a more conservative (and therefore “safer,” at least in theory) investment.

Recommended Action: Buy SPEU.