Over the past few years, Rithm Capital Corp. (RITM) has grown primarily through acquisitions to become a diversified asset management company. However, from the share price action, it is apparent that the investing public still views RITM as just another finance REIT, advises Tim Plaehn, editor of The Dividend Hunter.

Before we look at the current Rithm Capital business operations, let’s take a quick look at earnings and the dividend coverage. The RITM dividend has been level at $0.25 per share quarterly for the last four years. Over that time, non-GAAP EPS/distributable income per share has increased from $0.34 to $0.54 (as of Q3 2025).

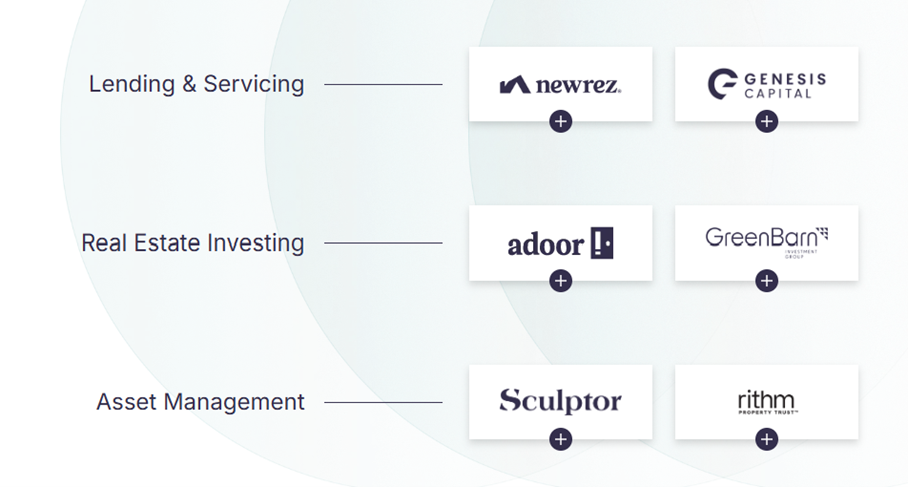

Management has stated they are focused on growing the company and have no plans to increase the dividend. However, with annual earnings over $2 per share, the $1 annual dividend is very secure. The company website shows these primary businesses...

Newrez is a residential mortgage lending company. Genesis Capital is a commercial lender to real estate developers. Adoor is a single-family rental business, with Rithm owning and managing a portfolio of rental homes across the country.

Meanwhile, GreenBarn is a commercial real estate investment firm, investing in both debt and equity opportunities. Sculptor is a global alternative asset manager. Plus, Rithm Property Trust Inc. (RPT) is a publicly traded commercial finance REIT managed by Rithm Capital.

In addition, on Sept. 4, 2025, Rithm announced the acquisition of Crestline Management LP. Crestline is a private credit and alternative asset manager with $17 billion under management. The acquisition closed on Dec. 1, 2025.

On Sept. 17, 2025, Rithm Capital announced the purchase of Paramount Group Inc. (PGRE). PGRE owns and operates $1.6 billion in high-quality office properties in New York City and San Francisco.

As of Q3 2025, RITM’s book value was $12.38 per share. With a $11.20 share price recently, RITM traded for 0.90 times book. Other asset managers with operations similar to Rithm Capital's, acquired through acquisitions, trade at 1.5 to 2.0 times book. This means that when investors start to figure out what Rithm Capital really is, there is potential for a 50%-plus gain in the share price.

Recommended Action: Buy RITM.