The notable drop in U.S. consumer confidence can be blamed on weather, government shutdown politics, geopolitical issues or it can be part of a larger cyclical turn, writes Bob Savage.

We all have blind spots, things that we can’t see, that potentially can derail out best laid plans. Today brought so much economic data that investors are likely to ignore the surprises of better French GDP, better Japan retail sales and better German confidence. There was plenty of weaker stories to offset all this as well – with the EU Commission Economic Sentiment clearly hitting home the idea that Europe is suffering a significant slowdown.

The FOMC decision today tops the focus for investors but plenty of other economic and political headlines make clear that trading in this environment has more blind spots than clear vision.

Let’s start with the non-economic news flows:

- UK Brexit votes yesterday drives GBP lower now flat. What changed with the amendments? Most analysts suggest nothing. The risk for a no-deal exit from the EU remains in play (Goldman lifts the odds from 10% to 15%), hope for EU talks on the Irish border issue seems misplaced.

- Japan Cabinet sees fiscal surplus in 2026. This is better than the 2027 from last year, and part of the forecasts released today with 1.3% GDP for FY2019 – even with the VAT tax plans intact. The budget of $900 billion is a new record high. Also markets worried about the new 10-day Golden Week announcement April 27-May 6 will be the longest break ever for shares and bonds as they celebrate Crown Prince Naruhito becoming emperor. Closing a market for nearly two weeks puts bonds and stock liquidity at risk.

- US/China talks restart today with CNY bid - The hope for talks on trade leading to a deal drives the CNY to 6-month highs today even as Huawei CFO extradition requests typify the intellectual property problem

- Apple earnings provided global relief for equities with MSCI all-country World up 0.1%. The firm didn’t report further bad news after its revenue warning linked to US/China trade fears hit markets earlier this month. CEO Cook noted US/China trade tensions have eased.

All of the focus on the British pound and the US/China trade deal has left the FOMC a bit of a window to do little and wait for more data and geopolitical news. Whether that patience is supported by the market now matters to the dollar. Many are more bullish on the euro but struggle to see the ECB or growth there driving it more than old-fashioned equity and bond buying flows driving it. The Chinese yuan’s move to key 6.71-6.73 support is another factor and the link to China growth continues to dominate. So, the focus today is likely on how the dollar handles the Fed doing nothing with all the blind spots at play about growth, confidence and the rest of the world.

FOMC today is all about the balance sheet

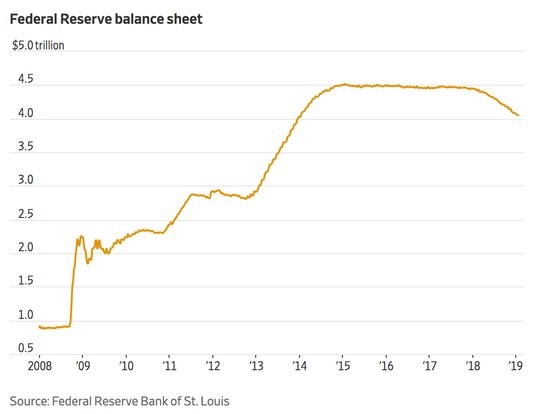

Expectations are for the Fed’s Federal Open Markets Committee (FOMC) meeting today to leave rate policy unchanged, to have a statement that is lightly changed to show financial conditions are tighter and a Powell press conference where the Chair offers some clarification on the balance sheet. The issue of just how many bonds and what duration the central bank holds of debt matters despite the best hopes of the Fed to put this “normalization” on autopilot. The rising risk in the market is that US bond yields go up not down. If we aren’t going into a recession fast, then the massive government spending and debt will squeeze on corporations and lift the level of yields. The 2.55% bottom seems to be in place unless we get some seriously bad economic news. The FOMC will need to talk about the balance sheet and how it sees the process moving forward as this will be the curve trigger and focus for many today.

As you can see from the chart below, the Fed has only just begun to unwind its massive balance sheet and is now facing push back over its unwinding policy.

Will consumer confidence matter to the FOMC? The notable drop in U.S. consumer confidence can be blamed on weather, government shutdown politics, geopolitical issues or it can be part of a larger cyclical turn. How the Fed looks at such indicators today will be another factor to consider. The Conference Board release yesterday should be a cautionary tale for those jumping in hoping for a significant growth bounce in the second quarter.