Markets in 2019 haven’t fully confirmed slowing growth, [but] markets are far from painting a growth-accelerating picture, writes Landon Whaley.

The government shutdown has disrupted the regular flow of data sets such as durable goods orders and retail sales, but since reporting has resumed, we’ve received some new data points worth discussing.

In last month’s update we covered the epic collapse in the ISM Manufacturing Purchasing Managers Index, which saw the largest one-month drop since the credit crisis. In classic mean reversion style, the ISM snapped back in January to 54.9 from December’s two-year low of 53.8. However, despite a headline acceleration (to a lower high), the survey results paint a different economic picture:

- Unlike in the last few years, we are experiencing a first quarter slowdown.

- Overall, business continues to be good; however, margins are being squeezed.

- Concerns about oil prices are fueling questions of how strong the economy will be [during] the first half of 2019.

The other critical takeaway from this latest ISM is that Prices Paid contracted for the first time since the U.S. industrial recession in the first half of 2016.

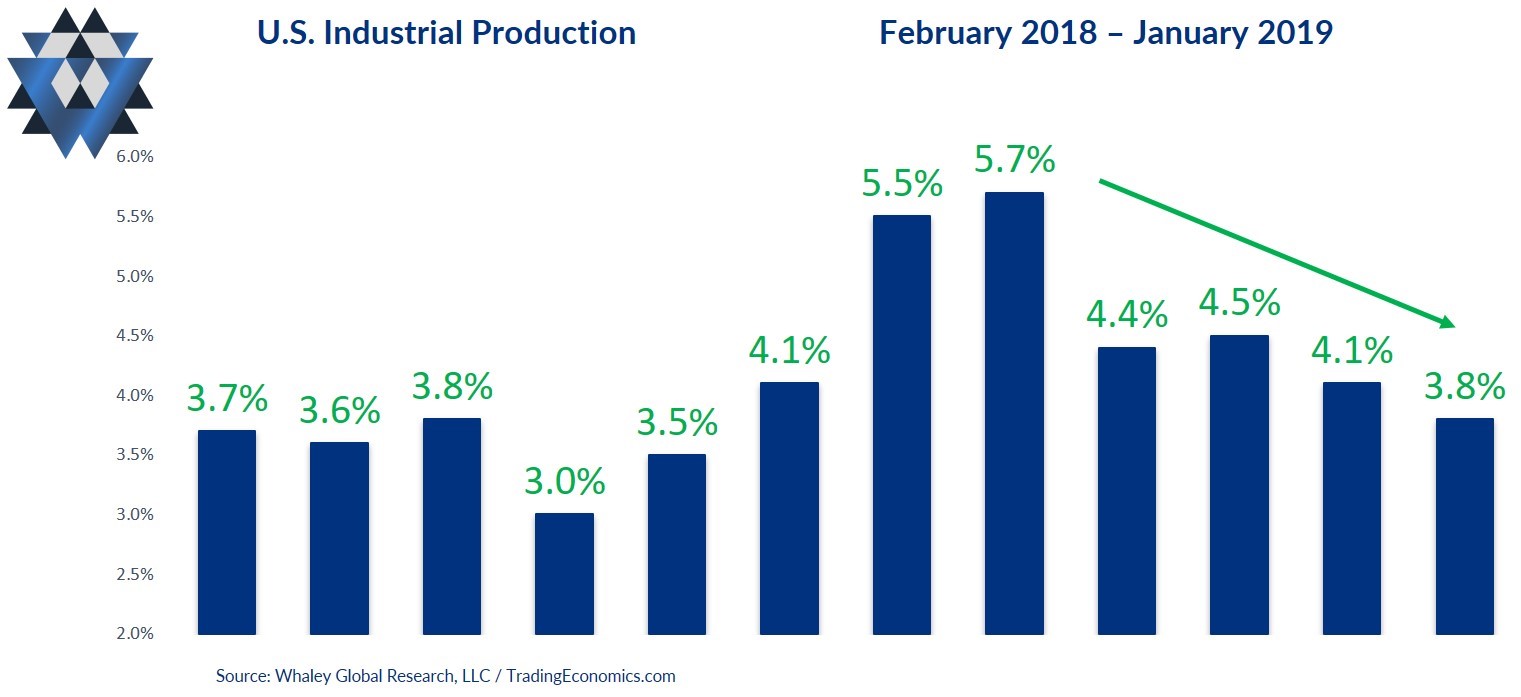

Outside the ISM, U.S. industrial production growth slowed for the fourth consecutive month in December and is now sitting at the lowest level since last June. Keep in mind that 70% of industrial production growth is driven by oil-related line items. This means that crude oil’s epic -31.2% Q4 decline has yet to be fully baked into the industrial production numbers. Mathematically speaking, there is virtually no way industrial production growth will accelerate in January or even February.

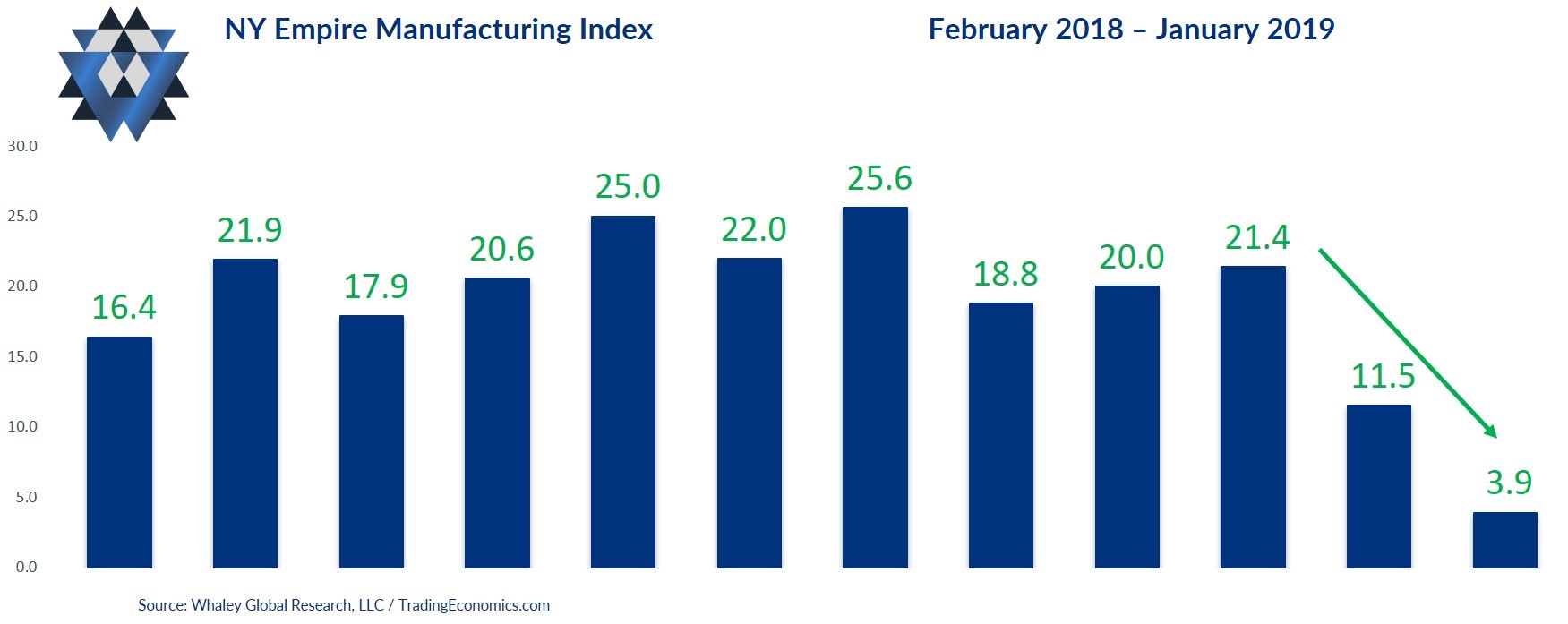

If we take a spin around the regional Feds’ manufacturing indices, we see slowing conditions to begin the year. The New York Empire State Manufacturing Index slowed for the second consecutive month in January, and the third in the last five months. The Richmond Fed’s own index was in outright contraction in January, the second straight month of contraction. The one bright spot was the Philly Fed index, which bounced modestly in January after four consecutive months of slowing.

On the services side of the economy, the Markit U.S. Services Purchasing Managers Index fell for the third consecutive month in January and has now slowed in seven of the last eight months. The ISM Non-Manufacturing PMI declined in December for the second time in the last four months and is sitting at the lowest level since July 2018.

The hard data bottom line is that growth unquestionably slowed in Q4 2018, and the few January data points we’ve seen are confirming a continuation of that growth slowing to start 2019.

The Bottom Line

Markets in 2019 haven’t fully confirmed this picture of slowing growth. That said, based on the way we slice and dice the quantitative aspects of markets beyond mere price action, markets are far from painting a growth-accelerating picture.

As one example, the “growthy” sectors (biotech, tech, basic materials, financials and transports) still haven’t retraced 50% of their Q4 drawdown and are all making a series of lower highs.

Four weeks of price action isn’t going to shake our confidence in our process or in this particular macro theme. As we recently mentioned, “U.S. growth is still only three months into a new growth-slowing regime, and it will face its own difficult growth comps against the second-longest expansion in U.S. history.”

For now, growth slowing is here to stay. The playbook remains to be long U.S. Treasuries (you pick the duration), and REITs have now made their way back into our good graces. On the short side of this macro theme, you can continue to bang away on financials, semiconductors and U.S. industrials on short-able bounces.