War beats peace in driving markets today, writes Bob Savage.

War beats peace in driving markets today. The search for safe-havens restarts with the Japanese yen and Swiss franc benefiting. The border clash intensifies with Pakistan claiming it shot down two Indian jets after it carried out six airstrikes on Kashmir. Ground forces are exchanging fire in more than a dozen locations. Both markets are suffering from the conflict and both are being urged to show restraint.

Meanwhile in Vietnam the U.S.-North Korea summit started with hope. “Vietnam is thriving like few places on earth. North Korea would be the same, and very quickly, if it would denuclearize,” Trump said on Twitter before the meetings.

The UK Parliament debates Brexit today. Markets are focused on the outcome as the “no-deal” hard Brexit risk was priced out of the market yesterday but the risk for delay, another referendum and more political confusion continues. Also notable is the Bank of Japan’s battle to push back deflationary pressures even as its QE and negative rates seems insufficient in the face of a slowing global trading environment. The BOJ dove Kataoka pushed for more action. “While not impossible, it’s hard to achieve the price target with monetary policy alone,” Kataoka said, adding that fiscal and monetary policies “must be on the same page” to change public perceptions that deflation will persist.

The German Bundesbanker Weidmann noted that economic weakness from the second half of 2018 persists but that pessimism is unwarranted given the foundations for growth from cheap financing, expanding employment and higher wages. He also got the greenlight for another term keeping his hat in the ring for replacing ECB Draghi. The markets are confused and stuck in between war and peace over politics and policy with the JPY and CHF the best barometers for fear today both are more stuck yellow than red.

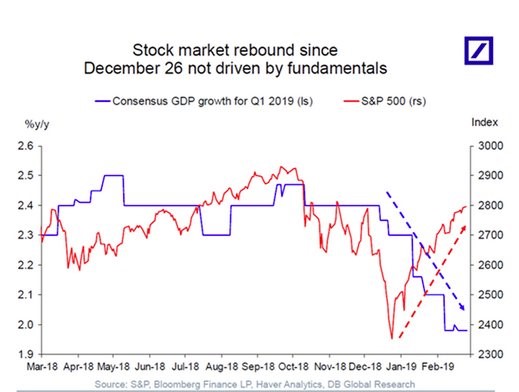

Do fundamentals matter?

Markets are a confidence game and the future expectations beat present conditions. The bounce in U.S. consumer confidence, (best in 18-years), and the slip to two-year lows in Europe, confused markets over the last 24 hours. The euro is holding bid over its 55-day moving average and has been rallying with US-China trade deal hopes. Watching 1.1450 and 1.1515 for a larger melt-up.

In a world where policy dominates - fiscal, foreign and monetary - the power of present economic growth and potential becomes secondary to investors. That is the world we live in and one that makes the rebound in equities since December that much more dangerous to sustain. This is the view from DB economist and one that is doing the rounds. "Either markets have to come down to where growth expectations are, or growth and earnings expectations have to move higher to justify current market valuations," said Torsten Slok, Deutsche Bank's chief international economist, in a note on Tuesday.