Payrolls slightly positive but hourly earnings tell the real story, notes Matt Weller.

The monthly U.S. Nonfarm payrolls component of the jobs report has a well-earned reputation for creating volatility in global financial markets, but even high-impact data is occasionally a dud.

As we anticipated in yesterday’s preview, the headline jobs figure did come out on the high side of expectations. According to the U.S. Bureau of Labor Statistics, the U.S. economy created 196k jobs in the month of March, topping economists’ estimates of 180k; the previous two jobs reports were also revised higher by a total of 14k.

While the headline quantity of jobs created was solid, the crucial wage component missed expectations. Average hourly earnings rose just 0.1% for the month, bringing the year-on-year rate down to just 3.2% from 3.4% last month. The fact that the wage growth remains subdued even as the U.S. economy continues to add nearly 200k jobs per month almost 10 years after the financial crisis and Great Recession signals that there is still slack in the labor market.

At the margin, today’s mixed jobs report supports the Fed’s big dovish shift last month. In other words, there is no urgency for the Federal Reserve to raise or lower interest rates, given that the economy continues to grow, there’s no evidence of an imminent pickup in inflation, and policymakers’ belief that interest rates are near neutral levels.

Market Reaction

Markets have taken today’s mixed jobs report in stride. Fed Funds futures traders continue to price in about a 50% chance of an interest rate cut this year (see below). The U.S. dollar, U.S. stock indices, gold and two-year Treasury yields are all trading within about 0.1% of.

Source: CME Group. Fed Funds Dec. 2019 contract

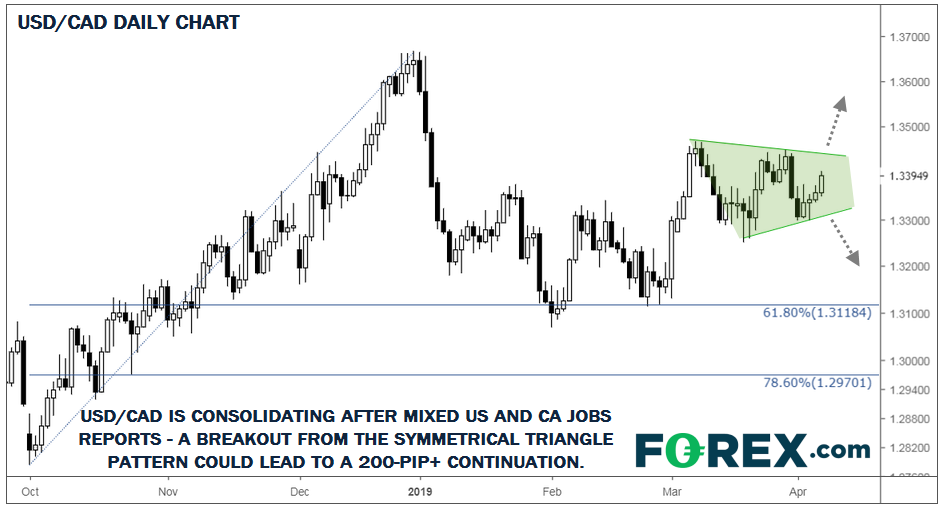

The only noteworthy move is in USD/CAD, where the Canadian economy got a mixed jobs report of its own and oil prices generally ticked higher. Taking a step back, the pair continues to consolidate in a symmetrical triangle pattern. Given the lack of clear trend heading into the pattern, the direction of the ultimate breakout is difficult to handicap, but we could see a 200-pip continuation if rates break above last week’s high near 1.3450 or this week’s low around 1.3300.

Source: TradingView, FOREX.com