I love reading about all the good news in the market. This past week, we saw U.S. jobless claims dip to 211,000, and they are now near half-century lows. We also saw U.S. consumer sentiment reach a 15-year high. So, what could go wrong?

Well, as Professor Hernan Cortes Douglas, former Luksic Scholar at Harvard University, former Deputy Research Administrator at the World Bank, and former Senior Economist at the IMF, noted:

. . . financial markets never collapse when things look bad. In fact, quite the contrary is true. Before contractions begin, macroeconomic flows always look fine. That is why most economists always proclaim the economy to be in excellent health just before it swoons. Moreover, the fact that consumer sentiment is hitting major highs is often a warning to the financial markets.

As Alan Greenspan also noted:

The cause of economic despair, however, is human nature’s propensity to sway from fear to euphoria and back, a condition that no economic paradigm has proved capable of suppressing without severe hardship. Regulation, the alleged effective solution to today’s crisis, has never been able to eliminate history’s crises.

And, when the market made a new all-time high in April, and some of the major banks and analysts were still calling for a “melt-up” to begin at that time, it seemed quite clear we were hitting euphoric levels, especially with the market rallying non-stop off the December 2018 lows.

In fact, when Apple (AAPL) hit the 215 region on the first day of May, many thought me crazy for shorting it at that time, especially when it was hitting those highs after what was supposedly a phenomenal earnings announcement. But that has been one heck of a profitable trade for which I was supposedly crazy to enter.

Indeed, we were seeing points of euphoria throughout the market.

I have also seen many note that one cannot foresee a black swan event which causes significant market declines (Of course, by definition no Black Swan can be seen!). While they may be correct in suggesting that one may not be able to foresee an event before it occurs, but markets do not crash without warning. Rather, one needs to have a set up in place before that occurs. As Ralph Nelson Elliott correctly noted:

At best, news is the tardy recognition of forces that have already been at work for some time and is startling only to those unaware of the trend.

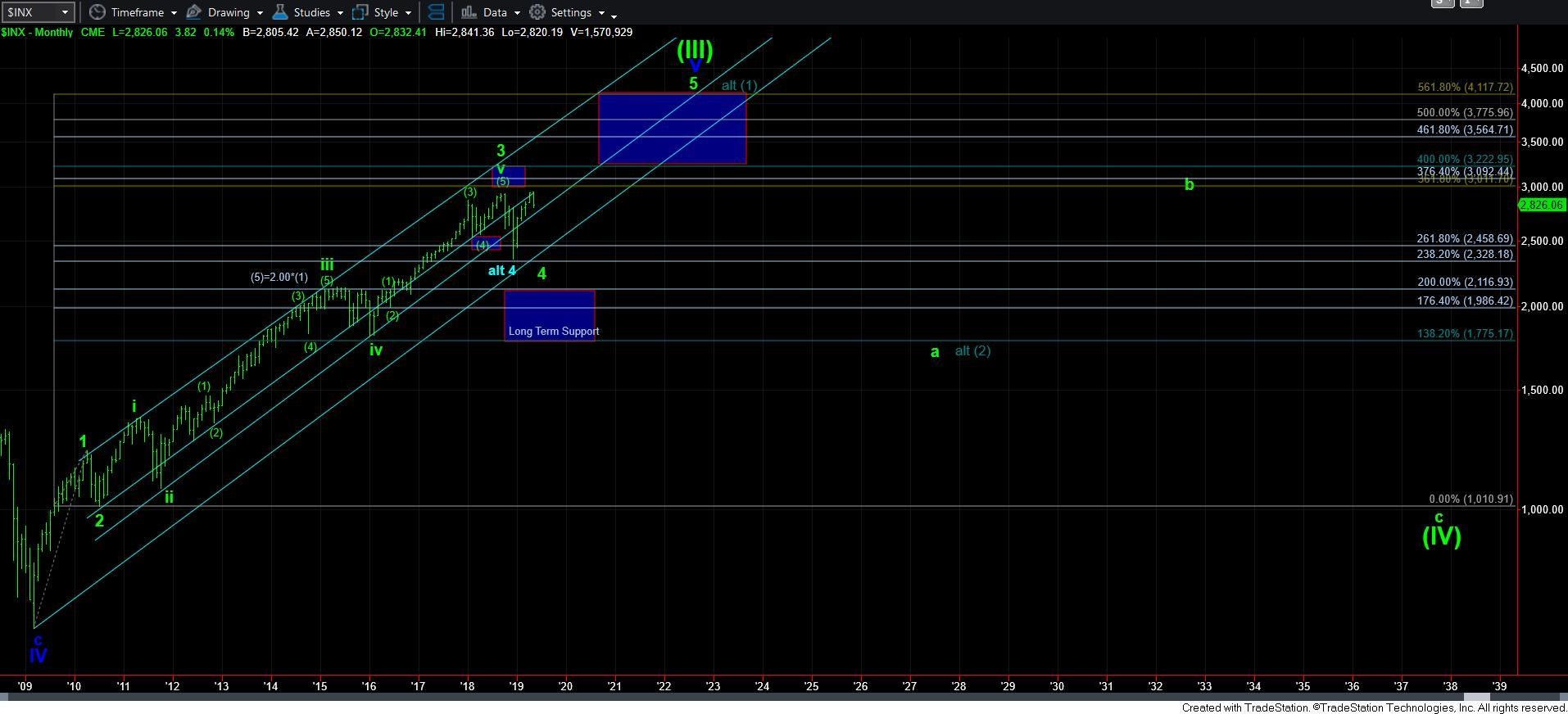

And, currently, the market is setting up in a manner which can shave off hundreds of points in a very short period. While I cannot guarantee this will happen, as life offers no guarantees, I can alert you to the fact that the set up for such a decline is now in place. And, should some news event hit the wires to seemingly cause the market to drop precipitously over the coming weeks, please do not tell me this was a “black swan” event which was unforeseeable. The set-up is currently in place.

Moreover, we constantly track the market in our service, and will be following the market down to make sure the impending drop follows through as expected. Should we see any counter indications, we will adjust accordingly in real time. That is the beauty of our Fibonacci Pinball methodology, as it keeps us on the correct side of the trend the significant majority of the time, and provides us early warning as to when we may be wrong so that we can adjust rather quickly.

While the micro structure can still push us higher towards the 2855/60 region, and maybe even stretch us as high as the 2900/20SPX region over the coming week, the next time we break down below the lows we struck this past week will suggest that the market is falling through an opened trap door. And, assuming we follow through immediately below 2770 om the S&P 500, that can present us with a waterfall event similar to what was seen in the fall of 2018, in January of 2016, in August of 2015, and in August of 2011. The same set up is now in place (see charts).

SPX 5-minute

SPX 60-minute

SPX Daily

SPX Monthly

But as I have said before – fret not. This drop will be a major buying opportunity to load up on the long side, as it will set us up for our trip to 3500+ in the SPX that I expect as we look towards the 2022/23 time frame.

View charts illustrating Avi's wave counts on the S&P 500.

Avi Gilburt is a widely followed Elliott Wave analyst and founder of ElliottWaveTrader.net, a live trading room featuring his analysis on the S&P 500, precious metals, oil & USD, plus a team of analysts covering a range of other markets. He recently founded FATRADER.com, a live forum featuring some of the top fundamental analysts online today to showcase research and elevate discussion for traders & investors interested in fundamental rather than technical analysis.