One volatility trader is betting that volatility is done for the year, points Jay Soloff.

The markets have certainly seen its share of ups and downs in 2019. There were quite a few spikes in market volatility this year – usually related to the China trade war or concerns over the direction of interest rates. There has also been a lot of talk about the U.S. economy falling into a recession, although those fears have alleviated somewhat by the aggressive action of the Federal Reserve.

With the economy chugging along at a non-dismal pace and interest rates at even lower levels than the historically low levels we started the year out at, investors have returned to their bullish ways in the stock market. We’ve reached new highs in the S&P 500, and the overall attitude of investors seem to be overly positive. Market volatility is way down as well, which I'll get to in a minute.

Is this the sign of a top? It’s too soon to tell, but it does seem like the worst is behind us for the time being— of course, that can change in a hurry. Nevertheless, the economy is slowing but not falling off a cliff, and the news concerning U.S.-China trade negotiations has been more optimistic of late.

There could be more action as we approach election primary season next year, but that really doesn’t get going until late winter/early spring. That means it could be a very quiet holiday season for traders.

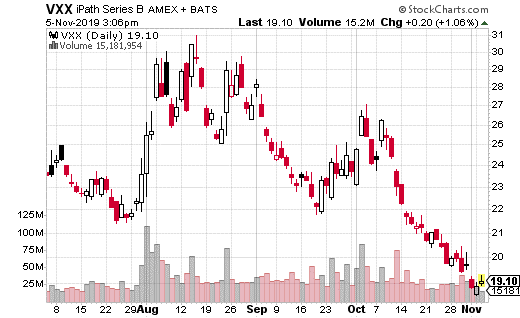

In fact, a trader recently made a very bearish bet on volatility through next January. The trade occurred in iPath S&P 500 VIX Short-term Futures ETN (VXX), which is the easiest (and a very popular) way to trade short-term market volatility.

With VXX at $19.20 (down 21% over the last month), the trader purchased the January 17 puts while selling the 15 puts for a total of 73¢ for the spread (long 15-17 put spread). A put spread (or call spread) is generally used to keep premium costs low while making a directional bet with options.

The spread starts making money at $16.27 or below, down to $15. Below $15 is max gain of $1.27. The most that can be lost on the trade is $73 per spread. From a percentage standpoint, the max gain will result in gains of 174%.

Cleary, this trader is betting that volatility is going to keep on falling. You can see from the chart that VXX has basically done nothing but drop in recent weeks. This put spread looks to be a bet that the trend will continue.

If you are a believer that short volatility is the way to go through next January, this could be a reasonable way to add some extra cash in your pocket. The put spread structure keeps the costs relatively low on the trade but still allows you to make 174% in profits.

Just a reminder, you need to be sure when entering any trade, you aren’t giving up any extra edge. If you are new to options trading, I highly recommend using a checklist to make sure you aren’t making any of the common mistakes of new traders. Even simple things like checking the expiration day and type of option can save you from throwing money away needlessly.

Jay Soloff is the Options Portfolio Manager at Investors Alley. He is the editor for Options Profit Engine, an investment advisory bringing you professional options trading strategies, with all the bells and whistles of Wall Street, but simplified so all you have to do is enter the trades with your broker.

See Jay discuss volatility at the Las Vegas TradersEXPO Nov. 7-9 at Bally’s/Paris Las Vegas!