Earnings season amid a planned global economic shutdown is difficult, but Amazon may be different, writes Fiona Cincotta.

Approaching earnings season in the era of Coronavirus is a difficult task. I am sure many firms would like to forego announcing earnings until they are once again reflective of company’s performance and not the fact that the global economy is self-quarantining itself to avoid the worst outcome in a global pandemic.

However, there are exceptions. While the past few weeks have brought turmoil of unprecedented levels to many stocks, Amazon (AMZN) is reaping notable gains as it emerges as the stay at home stock. As weekly Jobless Claims are now measured in the million, Amazon has actually been taking on additional employees.

Here is how we view their upcoming earnings:

When:

April 23 after market close

Expectations for Q1:

- Revenue $72.5 billion

- Revenue AWS $10.3 billion,

- EPS $6.35

3 things to watch:

1. Online retail surges

Amazon appears relatively safe from the Coronavirus hit thanks to its core business – online retail, which has picked up significantly amid the closure of brick and mortar outlets. Customers are ordering delivery en masse; the company is taking on an extra 175,000 staff to manage the rising demand. Expectations are the many people who started shopping online in the Covid-19 lock down will continue to do so even after the lock down ends. Also, crude oil prices tumbling will have reduced shipping costs significantly.

2. Cloud & streaming services

The cloud business is benefiting from lock down amid growing usage from existing and new customers plus AWS powers many leading apps such as Netflix, Disney+ and Apple. Streaming music and videos make it a major player in streaming wars, as streaming media becomes a popular past time for those forced to stay at home

3. Spending

Amazon’s spending is always worth keeping an eye on. Spending can outpace revenue even if sales are extremely strong. That said, we have seen in previous efforts such as building out fulfilment centers and cloud computing data centers and investment in Prime one day shipping, that Amazons willingness to spend can be beneficial.

Levels to watch

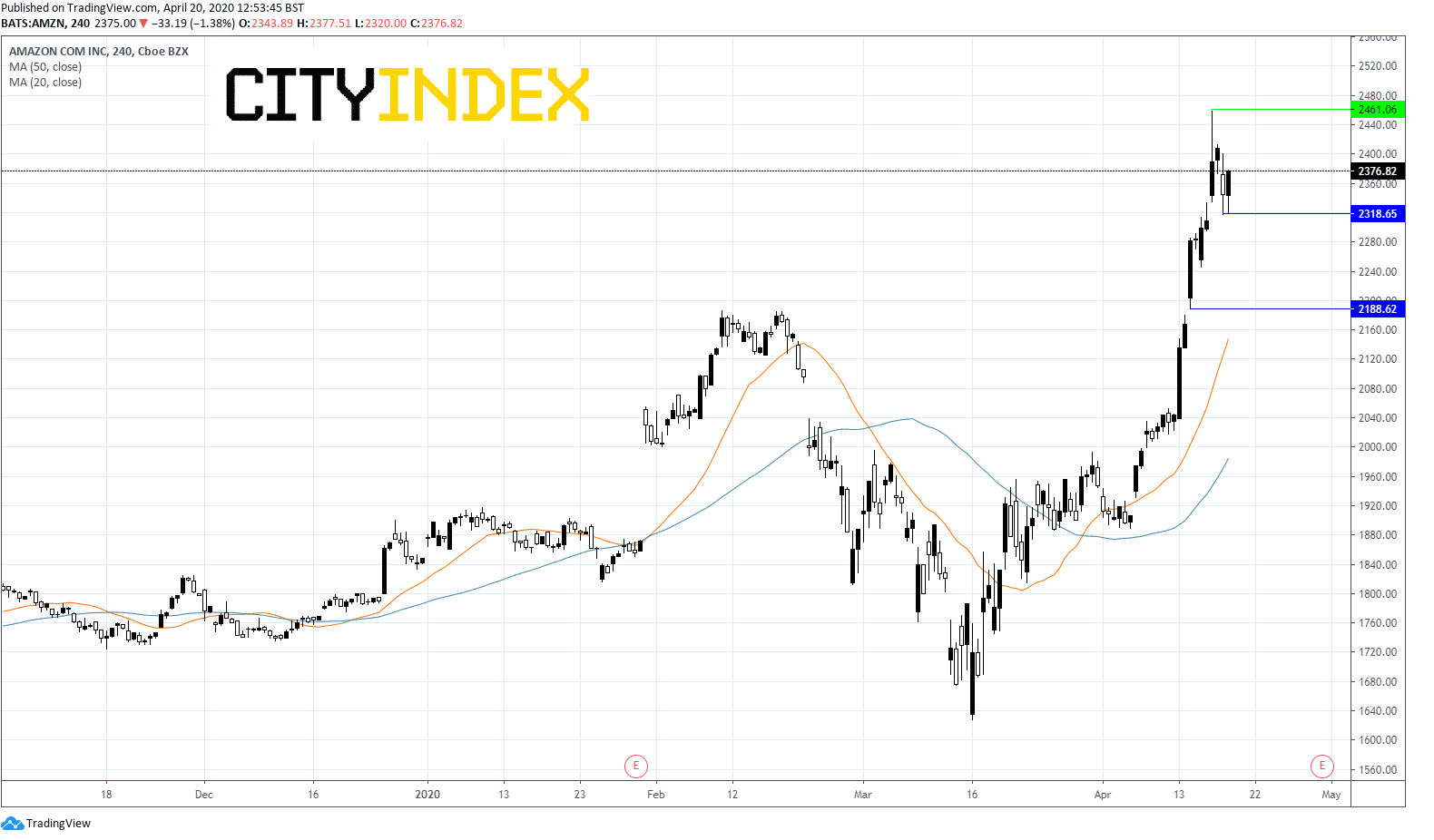

Amazon surged to a record high of $2,461 on hopes on hopes of a Coronavirus related boom. The share price has just eased back slightly.

Amazon trades well above its 20- and 50-day simple moving average (SMA) in a firmly bullish chart (see below). You can see that a bullish signal was created (when most other stocks were tanking) in late March as the 20-day SMA crossed above the 50-day-SMA.

Immediate support can be seen at the April 17 low of $2,318, but a test of the of the Feb. 19 high of $2,170, prior to the broad market sell-off, is key.

Fiona Cincotta is a Market Analyst for Currency Live