Federal Reserve Chair Powell assures that the fed has the markets back, report Adam Button.

Federal Reserve Board Chairman Jerome Powell left no doubt that the Fed will support risk assets no matter how the Coronavirus evolves in comments after yesterday Open Markets Committee (FOMC) meeting.

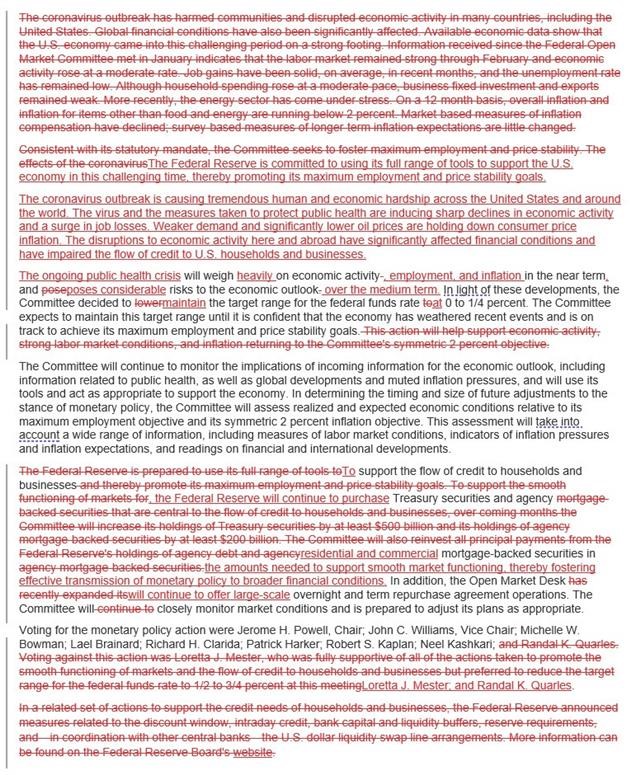

Below is the strikethrough comparison text from today's FOMC meeting and the March meeting.

Any hawkish hint from the Fed would have been a threat to suddenly-cheerful financial markets at Wednesday's FOMC but there was nothing of the sort from Powell. The Fed chair was abundantly clear that they are prepared to do more if there is a stumble; and that they're prepared to keep rates at the bottom longer to support a strong recovery.

It's a classic Fed put and markets sniffed it out ahead of time with the help of strong earnings. The U.S. dollar was soft ahead of the FOMC and drifted lower afterwards. Interesting spots to watch in the day ahead will be gold, silver and bitcoin.

The day ahead features another round of US initial jobless claims, but despite the eye-watering numbers, it has failed to dent sentiment at any time during the pandemic. The larger event will be the ECB announcement at 11:45 GMT and Lagarde at 12:30 GMT.

The ECB President will see Powell as a blueprint for how to communicate but the market is also expecting action to pull down Italian yields. The ECB doesn't have the same powers and flexibility as the Fed so threats of action don't carry the same weight; the market will want action.

Watch this space for a conversation with Ashraf on Trends in Yield Differentials

Adam Button is co-owner and managing director of ForexLive.com and a contributor at AshrafLaidi.com. You can see Ashraf’s daily analysis at www.AshrafLaidi.com and sign up for the Premium Insights. Ashraf's Tweet on indices here.