In early June, the S&P corrected about 300 points in a handful of days. Thus far, we are seeing a similar pattern in early September, explains Carley Garner.

If seasonality has anything to say, we should follow the same pattern. Specifically, our friends at MRCI suggest traders buying the E-mini S&P 500 on September 9th and holding through the 19th have been profitable about 93% of the time in the last 15 years. That said, seasonals also suggest late September could be rough. With these data points in mind, we believe support in the ES near 3,280.00 will hold and if so, the rally could surprise the bears. We know what happens when the bears are caught off guard...a short squeeze.

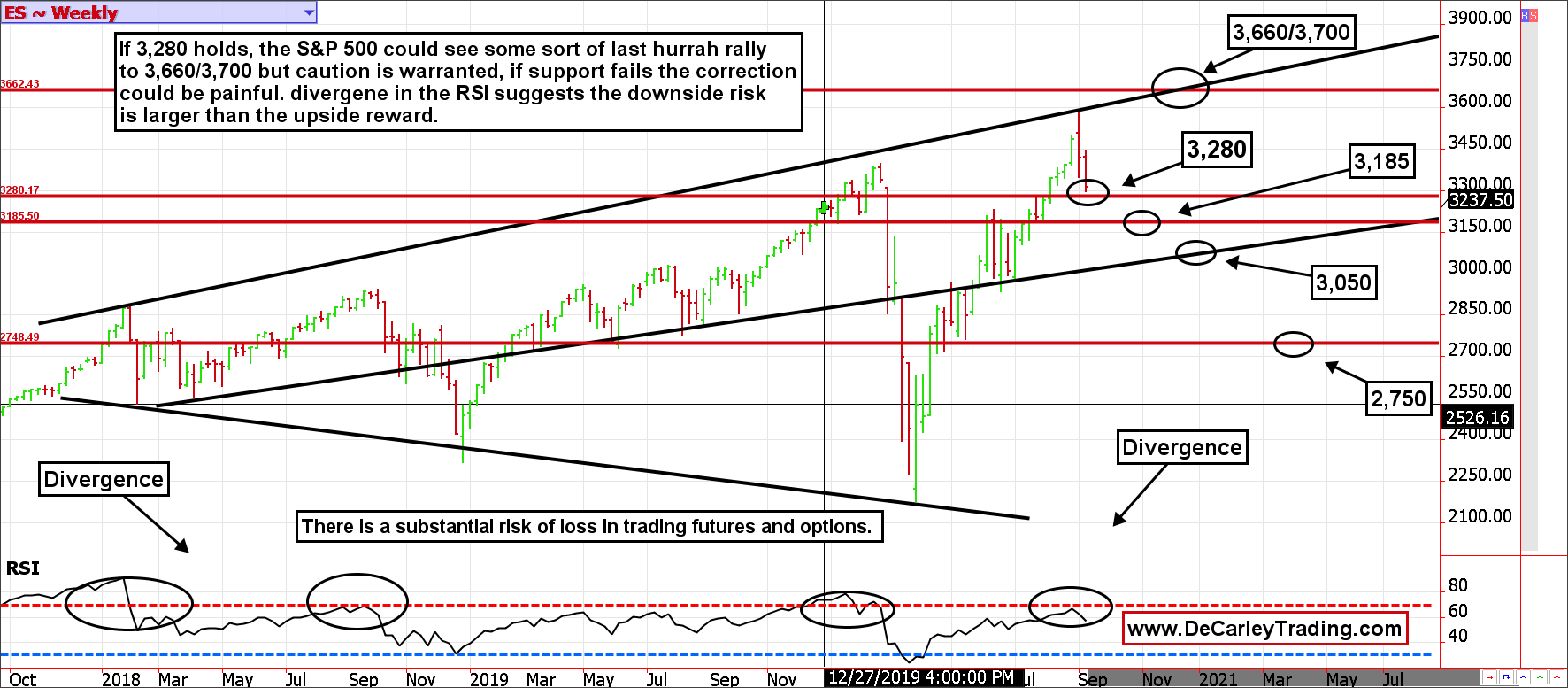

The bulls and bears will likely be battling for 3,280.00 early next week. As long as the market remains above (a quick intraday pierce doesn't count) the bulls have an edge. Yet, if this level fails, things could get ugly. Nevertheless, at this time, we are expecting support to hold and for prices to firm up in the coming week or two.

It might seem far-fetched today, but a run to 3,660.00/3,700.00 isn't out of the question. In fact, that is what the chart is suggesting. That said, if prices do reach such levels, the bears will be out in force...as they should be.

Divergence on the weekly chart suggests the rally is on loose footing. The last time we saw RSI divergence in this manner, the S&P peaked out in early 2018 and failed to make progress until about a year later. We suspect the recent rally might have pulled gains forward in a similar fashion.

Treasuries generally soften around rollover, is this a delay or an odd year?

When the futures market front-month shifts from September to December, we often see prices start to retreat. However, this time around the selling has been sluggish. I suspect recent volatility in the stock market, as well as reluctance to fight the Fed is keeping the 30-year bond and 10-year note supported. However, I have also learned when the masses have assumed a particular market scenario, such as negative interest rates or at least lower for longer yields, the environment is ripe for surprises.

According to the latest COT report issued by the CFTC, speculators are heavily long the 10-year note but short the 30-year bond. Yet, money managers are largely long the long bond. The last time we saw money managers this long an asset class was the S&P 500 futures in February...and we all know what happened then. Accordingly, as long as the December 30-year bond stays below 179'0 we believe the bears have an edge.