It goes without saying that the global outbreak of Covid-19 had a significant impact not only on the global economy, but on the stock market as well, says Konstantin Rabin of BrokersOnline.com.

The general pattern with US and UK stocks was that they reached a peak level by the end of 2019 or by February 2020.

This was followed by a sharp decline during the March 2020 stock market crash. During the subsequent period, the majority of stocks recovered some of their losses. However, it is worth noting that not all of them managed to return to the February 2020 highs.

Here, it is important to point out that not all stocks have been affected to the same degree. For example, the shares of those companies that operated airlines, cruises, hotels, and restaurants have faced the largest decline. This makes sense, since the outbreak of the pandemic, as well as subsequent lockdowns and restrictions, have hit those types of businesses the hardest.

On the other hand, online retail, home entertainment, and payment processing firms have seen their revenues rise. As a result, the stocks of those companies were able to recover from the March 2020 stock market crash. In fact, some of them even managed to get back to February 2020 highs and even surpass those levels. Something we will discuss later in more detail.

Decline in Airline Stocks

As mentioned earlier, the airline industry was heavily affected by the outbreak of the pandemic. In fact, those companies had to keep their entire fleets grounded for more than two months, due to travel restrictions imposed by the governments around the globe. In addition to that, it is worth noting that there are still some countries where the travel restrictions are not yet completely lifted.

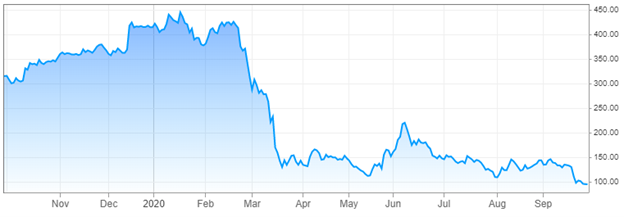

As a result, those types of businesses suffered significant losses in terms of their revenue and profitability. Consequently, it is not surprising that this had a sizable impact on their stock prices as well. To illustrate one example of this type of situation, let us take a look at this chart, which shows the stock price movements of International Airline Group (ICAGY), for the last 12 months:

As we can see from the diagram above, back in October 2020 the stock was trading close to the 300p level. During the subsequent months the shares made some steady gains, eventually going as high as 450p by January 2020. This represented a 50% rise in a stock price in less than four months’ time, which is quite an impressive return on investment.

Despite this development, and just like with so many other stocks, the IAG shares fell victim to the March 2020 stock market crash. From mid-February until the middle of March 2020 the stock faced a major decline, falling all the way down to 140p level.

Regardless of this notable decline, the market optimism did help the stock to recover at least some of its most recent losses. As a result of this process, IAG shares climbed up to 220p by June 2020.

Yet, those gains were eventually proven to be short-lived. It did not take long for the market to realize that it might take years for the airline industry to recover from the damages of the outbreak of Covid-19. This perception was reinforced by the fact that many countries experienced the resurgence of coronavirus cases. The obvious conclusion from this for the market was that there was more hardship in store for airline companies to overcome in the future.

As a result of this perception, the IAG stock simply resumed its decline, and by the end of September 2020, had dropped all the way down to 91p level. It goes without saying that this was a serious blow to IAG shareholders. It is worth remembering that back in January of 2020, the stock was trading near 450p. This means that in less than nine months the stock lost more than 80% of its value.

Obviously, at this stage, some investors might look at IAG stock as representing an extremely undervalued opportunity. However, the problem here is that it is not entirely clear whether or not the firm will be in a position to restore its profitability in the foreseeable future.

The Case of PayPal (PYPL)

It goes without saying that many firms have suffered due to the outbreak of a pandemic, with the stocks of those companies also facing a sizable decline. However, for the sake of accuracy, it is worth noting this is not the case with all corporations.

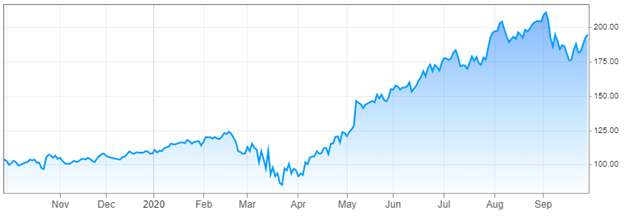

In order to illustrate one exception to this general trend, let us take a look at this chart, which shows the share price of PayPal Holdings for the last 12 months:

As we can see from the above image, back in October 2019, the shares were trading near $100 level. The shares have made some notable gains during the following months, eventually reaching $125 level by February 2020.

This stock was also impacted by the March 2020 stock market crash, with the shares temporarily dropping all the way down to $85. However, from April 2020, the stock began a steady recovery, erasing all of its recent losses by the beginning of May of the same year. In fact, this sort of upward trend has persisted for several months with the stock trading near $195 level by the end of September 2020.

This means that during the last 12 months the stock price has risen by 95%, which is an impressive rate of return for investors. There are several reasons for this success. The fact of the matter is that as many people had to stay home for extended periods of time, they purchased their groceries and other products online, many of them using PayPal as a method of payment. In addition, the threat of viruses led to a general reduction in the use of cash in many countries. As a result, many payment-processing companies have benefited from those developments.

The only downside with PayPal Holdings stock is the fact that this recent appreciation has made the stock significantly overpriced. According to CNBC, the price-to-earnings ratio of the stock, also known as the P/E ratio is above 89, which suggests that at the moment the shares have reached an extremely overvalued level.

By Konstantin Rabin of BrokersOnline.com - an online trading brokers comparison website.