Last week I asked you rhetorically if you thought the remaining time to the election would go smoothly says, Jeff Greenblatt of Lucas Wave International.

Since then the President of the United States tested positive for Covid and spent several days in the hospital. I like to trade the evening session for the Dow (either YM or MYM) and suddenly it had a great big drop. My wife screamed I should’ve been in at that moment. If it were only that easy. After it was over, I checked the Kairos readings and this one would have been tough to catch.

That being said, I know when the sleepy evening session wakes up like that, something had to happen. A few minutes later I found out Trump had tested positive. With all kinds of spin one thing is certain, the market is rooting for Trump. Since then markets have recovered along with the President’s health. Upon returning to the White House, Trump called off negotiations with the Democrats on a stimulus plan the public so desperately needs. The market didn’t like that either. But true to form, the next morning Trump was once again attempting to revive a deal. You know the drill; he did this endlessly with China.

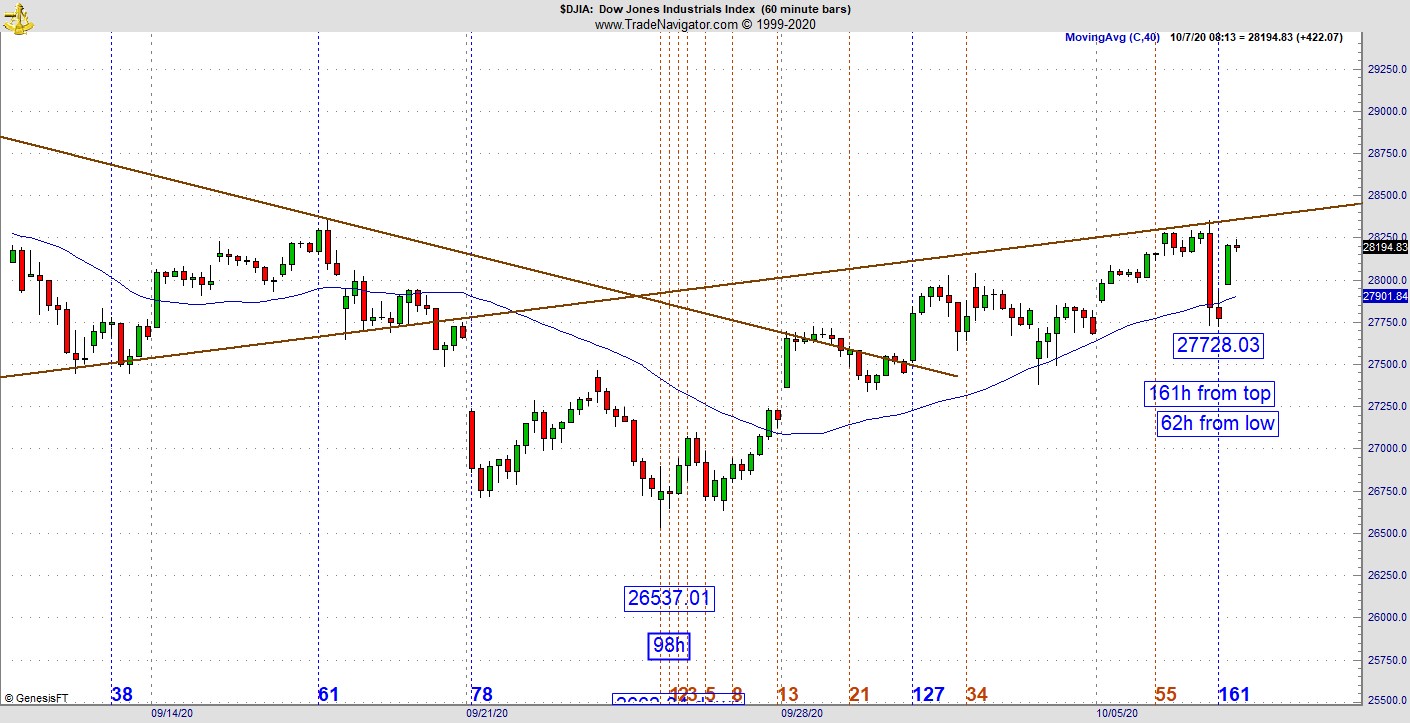

The Dow chart, which is a continuation of what I showed you last week, is hanging on and holding that Kairos reading at 98 hours. Here are two perspectives, the daily and hourly. From the daily we can see how important the trend/magnet line is. What has been guiding the pattern at least from June 26 is now operating as resistance. Last week I told you this line was the last roadblock to serious upper testing of resistance.

From the hourly we can see the Tuesday low is 161 hours off the top while it is also 62 hours off the low. This kind of price and time reading (the range from the top vibrates as well at 2662) has what it takes to break through this line. The longer it hugs the line, the better the odds it will eventually get pierced. But the real takeaway from this chart is to realize that trend lines don’t end just because they’ve been pierced. Markets are non-linear, and in terms of chaos theory, these trend lines become strange attractors, which is why I call them magnet lines.

Here’s an intraday trade showing the importance of correctly recognizing the value of a magnet line.

This action is from Tuesday night where I extend the early phase of a trend line in an uptrend across the page where the new downtrend bounce is attracted right to that line where price and time lines up for a surgical strike trade. In this case, a small intraday bounce of 22 points lines up at 21 minutes off the high. An immediate drop 48 points in 5 minutes won’t make you rich but consider if you know what you are doing, you can almost make something happen out of nothing. Do not try this unless you know what you are doing and have successfully pulled it off numerous times on a simulator. The action doesn’t always line up this way, but if you are patient and disciplined, you can pick your spots.

The reward for being patient is finding a tendency like this at least several times a week. Some of you call this scalping, I call it a surgical strike because I wait for everything to line up and don’t overstay my welcome. In another post I talked about staying long enough to get a bunch of points quickly. The time to enter something like this isn’t at the big red bar. You need to be in before it materializes and understand once it happens, it is likely the end of the move. The exception is obviously if we catch an all-in day either up or down.

Those conditions materialize at least once a week, but as a trader, you want to know what your edge is, have the courage to act, and not be greedy as those points are taken back even before the top of the hour. But the way you accomplish this type of precision is lots of practice. What ends up happening is every time you see a tendency develop, your left brain records it. New neuropaths start to grow until you start to recognize a configuration like this as opportunity.

You’ll need it as time rolls onward to the election and beyond. There are at least three elements to consider. There are the events going on in the world, the market continues on its way and most important is your reaction to everything. If you take a highly discipline approach to trading and can recognize when your edge appears, you should do well. If you don’t have this type of firm foundation you will be swept away by the wind.

What will be next in the news? It never ceases to amaze because most of what is going on, you can’t make it up. Truth has become stranger than fiction. Stay disciplined and live to fight another day.

For more information about Jeff Greenblatt, visit Lucaswaveinternational.com.