Biden’s election win and Pfizer’s vaccine announcement were a shot in the arm for equities. The Help-Up strategy is a pure play on any large stock market, and the US version triggered on election day. The position was up 13.4% at Friday’s close, states Ian Murphy of MurphyTrading.com.

Click charts to enlarge

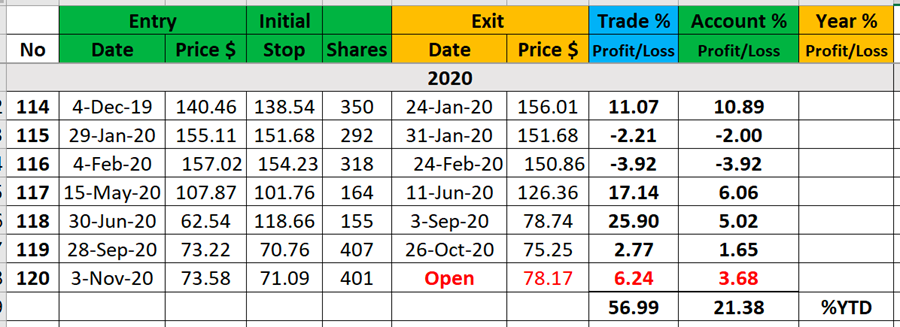

I bought 800 shares in the ProShares Ultra S&P500 ETF (SSO) and scaled out 200 after a 1ATR move to the upside. The quarterly lookback trailing stop has flatlined at $78.17 (red line) and the outlook is positive as the Pessimism Indicator (black arrow) is at 1.97%. When this indicator stays down the S&P500 keeps going up, it starts rising before a pullback.

This is the seventh trigger in 2020 and the back tested results are up 56.99% YTD on raw trades and 21.38% on a $50k simulated account risking 2% per trade in SSO (without leverage and excluding dividends).

Back to the Futures

Traders looking for a pure play on US equities sometimes require more liquidity and leverage than offered by an ETF. They might also prefer to manage gearing in-house and want access to the markets 24/7. In addition, EU-domiciled traders are unable to trade US-listed ETFs such as SPY or SSO if they are classified as “retail clients” by their broker.

Micro E-Mini futures are a solution to these challenges. Offered by CME group, micro contracts offer huge liquidity, 24-hr trading on weekdays and are affordable for most accounts—one S&P 500 Micro E-Mini currently costs approx. $17,900.

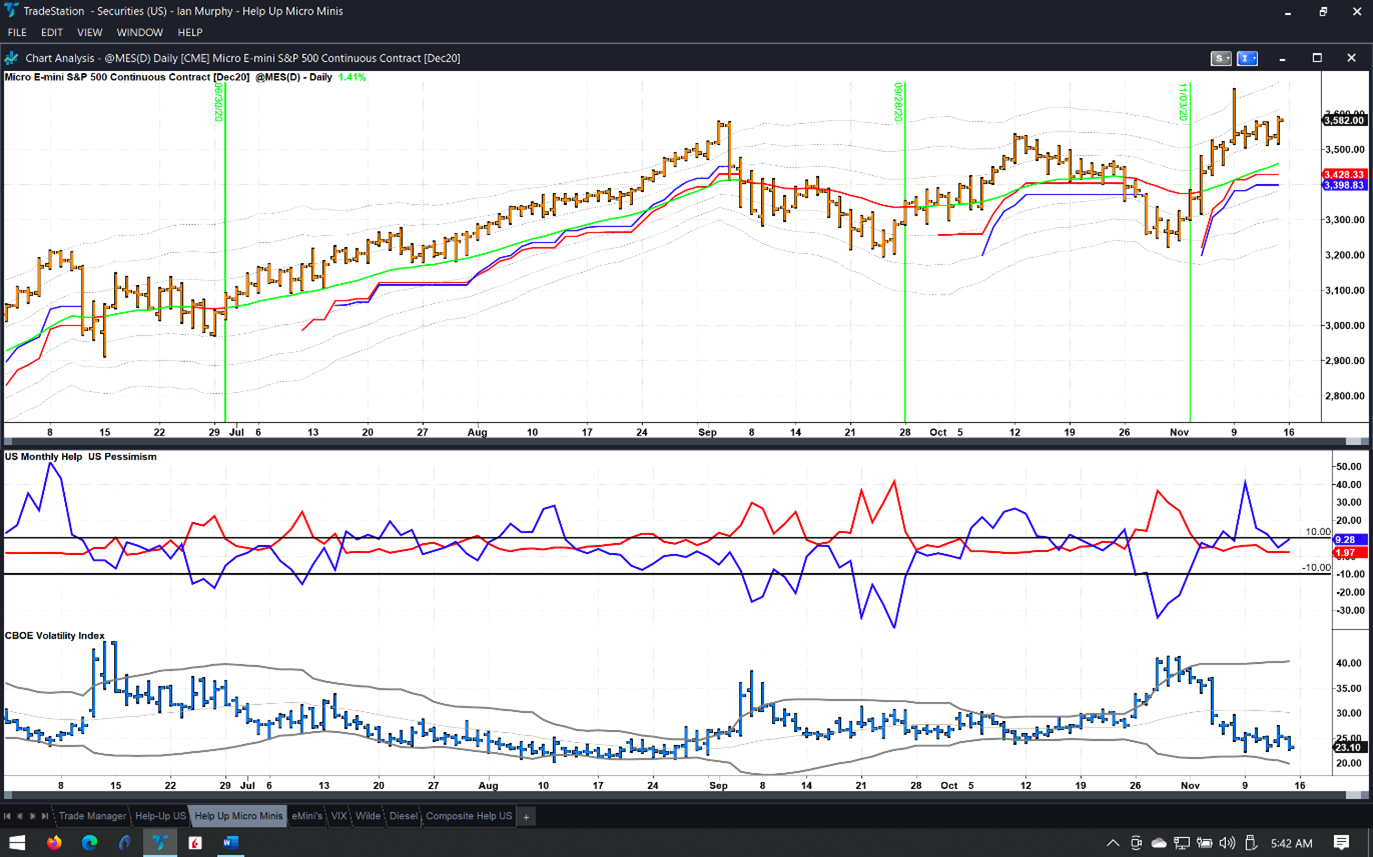

The US Help-Up strategy can also be traded with futures and trigger 12 on the micros is up 6.6% (without leverage). The quarterly trailing stop is at 3428.33, the monthly at 3398.33. The current contract (MESZ20) expires on December 18 and assuming the trade is still open, should be rolled into the March contract (MESH21) from December 10.

Chinese Equities

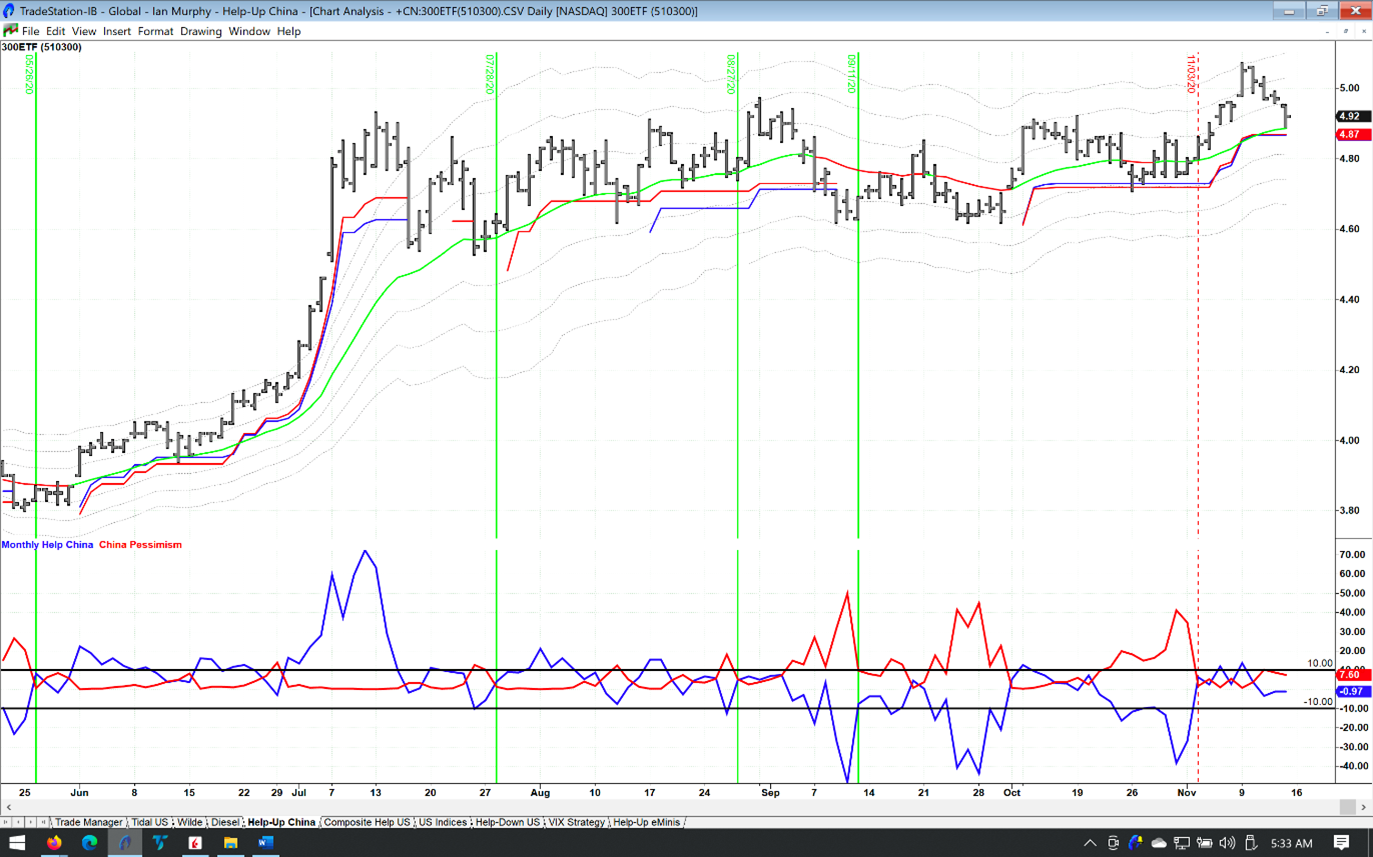

Covid-19 is firmly under control in China and share prices started to pick up again after trending sideways since July. The US election gave equities a boost on November 3, but antitrust regulators took the steam out of the rally by clamping down on tech firms deemed to be engaged in anti-competitive behavior—the deferred IPO of Ant group being the most visible casualty.

The China Help-Up strategy had a cluster of weak triggers on 300ETF (510300) since July, but this is to be expected in a trendless market. However, the trigger on May 26 (far left of chart) gave 21.5% profit before being stopped out on July 16.

Technically the bounce on November 3 (red dashed line) is not a valid trigger because the price signal and washout did not occur within five days. Coincidentally, both protective stops are currently at 4.87. This is a common feature after a trendless market because quarterly and monthly realized volatility converge.

This version of the Help-Up strategy is documented in a new chapter in the simplified Chinese translation of Way of the Trader, which has just been published in mainland China. My thanks to Bo Lu in Beijing for his assistance with the New High-New Low data and back testing on this.

Wilde Strategy

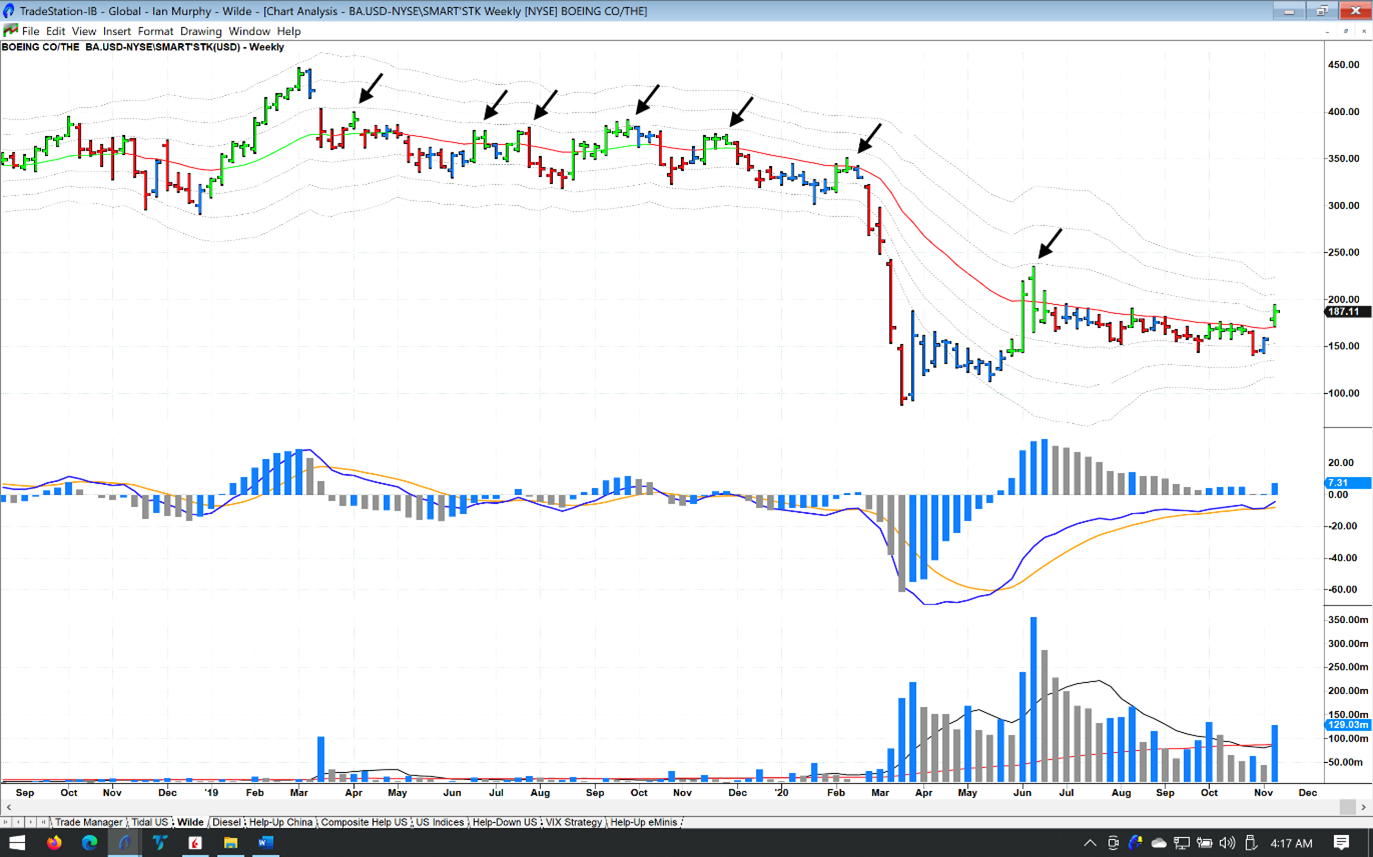

In the October mid-month review three US tickers were identified as potential Wilde trades, Boeing (BA) appears to be setting up the best so far.

This week Boeing closed above the 21EMAC on a weekly chart and Elder Impulse turned green, meaning the moving average and MACD-H have turned up. Price needs to close above the 1ATR channel now ($188.54), which it failed to do on seven occasions since March 2019 (black arrows).

Unlike the Help-Up, SPX Volatility Index (VIX) and Diesel strategies, which take their triggers from clearly defined technical signals, this strategy uses a more discretionary approach. Entries are based on a breakout and first higher-low pattern forming at support. As a weekly trend following strategy entries are more forgiving but exits are on a trailing stop calculated from realized volatility.

Success with this strategy depends on an abundance of discipline and patience. We must possess the patience to wait for months (or years) for the entry signals to manifest on the chart and the discipline to act when they do. Once in the position, it requires enormous discipline to leave our orders on a trailing stop in the face of regular pullbacks, and limitless patience to hang in there for months (or years) until the stop is hit.

Weekly trend following strategies are widely considered to be the most profitable form of trading, but most traders lack the emotional tools to trade such strategies successfully.

Learn more about Ian Murphy at MurphyTrading.com