Part of the Fed statement says the following, “The path of the economy will depend significantly on the course of the virus, including progress on vaccinations,” explains Jeff Greenblatt of Lucas Wave International.

Translating Fed-speak to English means the economy will continue to tank. The Fed is doing everything in their power, which basically means keeping interest rates near zero and expanding their asset-buying program every month.

Let us use a trading analogy to get to the bottom line. In trading, you don’t get paid for busy work. Traders get paid for taking the right action at the right time. There is only one thing that can improve this economy and that is to open it back up all the way. Anything short of that will lead to disaster. It’s not a matter of if but when. What is happening to the middle class is simply heartbreaking.

That’s basically all you need to know about the Fed meeting. The market was already going down prior to the announcement, in the immediate aftermath the Dow dropped another 250 points while the S&P 500 (SPX) was down over 2%. Finally, the market was not fooled.

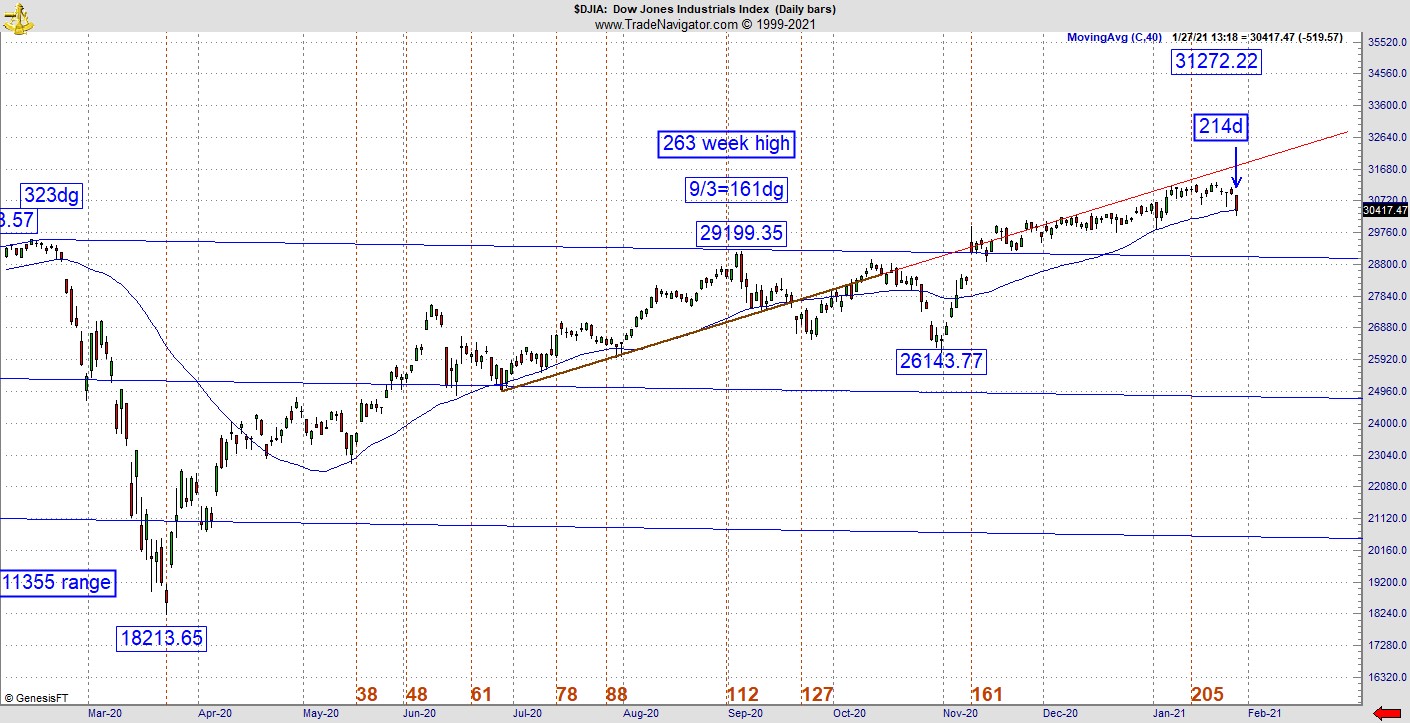

The price and time relationship are remarkably interesting at this juncture. Look at the bottom in the Dow from last year. It’s 18213.65. Fed day Wednesday just so happens to be the 214th trading day of this rally. Wednesday was also one of the biggest red bars on the Dow in recent memory. The question here is whether there will be follow through. Last week I talked about the major long-term cycle, which calls out February as the 144th month of the rally from the bottom in 2009 while February 22 will mark the 233rd trading day since last year’s low.

Since we are in the 143rd month right now, the time window may have just activated. Markets don’t necessarily turn on the Fibonacci window, they could turn on some vibration tied either to the range or price pivot. This chart is a perfect example. Is it going to follow through? My job is not to predict but look at overall risk, which is suddenly extremely high. The bottom line here is conditions are ripe for a change of direction.

The bottom line to this cycle work depends upon follow through. It could be a bear trap as we are so close to the larger cycle point, I’ve discussed for February. On the other hand, Elliotticians will tell you a wave could truncate, which generally leads to a more serious correction. We are early in the 144-month time window and if it goes now, it could lead to a brutal selling wave.

MoneyShow’s Top 100 Stocks for 2021

The top performing newsletter advisors and analyst are back, and they just released their best stock ideas for 2021. Subscribe to our free daily newsletter, Top Pros' Top Picks, and be among the first wave of investors to see our best stock ideas for the new year.

Let’s talk about picking tops, which is basically what you’d be doing if you got short on a condition like this. What I’ve found from trading hundreds of intraday situations is it doesn’t pay well to pick tops or bottoms. Its more profitable to be patient and have the discipline to wait for a secondary high. The reason so many intermediate-level traders pick tops and bottoms is the fear the train will leave the station without them. Hint: if you can resist the urge to act prematurely or the fear of losing out, it might just change your trading destiny. I’ve heard the best traders say they can pick tops or bottoms 60% of the time. Since high or low pivots generally lead to 1st or A waves (which are usually the shortest waves in the progression), you can see the problem in picking tops or bottoms as a trading strategy. If you are right and take 1st waves 60% of the time, it means you are getting stopped out 40% of the time. If you trade the top or bottom, odds are high you’ll have to sit through an agonizing retest if you last that long. That could be the reason some of you win a few, lose a few, and never get ahead consistently.

The advantage of trading secondary pivots gives you the edge of stumbling into big moves because odds increase, you’ll be trading 3rd or C waves more of the time. The economics of trading suggests keeping losses small while letting a winner run. How can you let a winner run if you are committed to trading legs that usually have steep retracements? If nothing else, the heat one must take to get to the 3rd wave can totally burn out an aspiring trader.

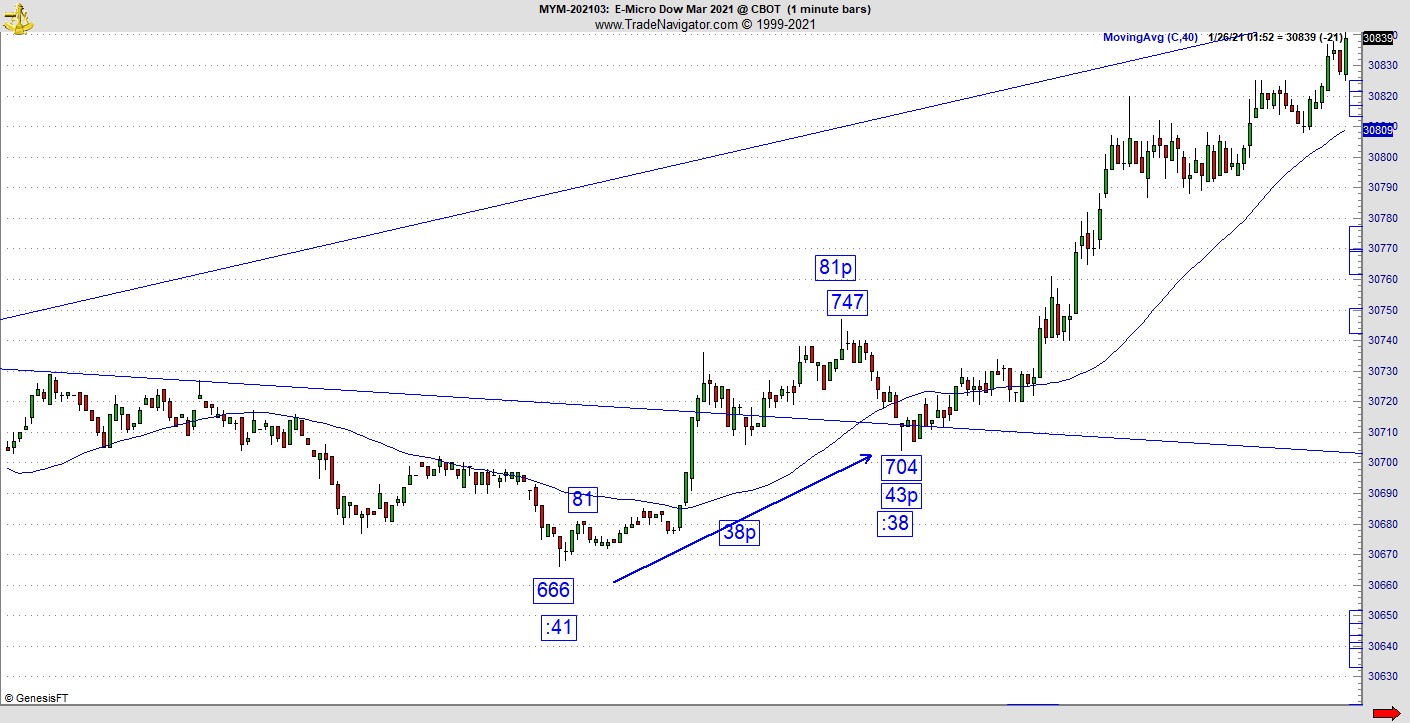

Here’s a great example of what I’m talking about.

For those of you who want to trade futures but don’t want to deal with the speed of the market during the day, an alternate way to deal with this condition is to trade the E-mini/E-micro-overnight action. In this case there is a bottom at 30666 (666). The secondary low in this case hits at :38 minutes after the hour while the secondary low back to the bottom is also 38 points, a perfect vibrational square out. I couldn’t tell you this would lead to the best part of the move but when you do the right thing, odds are the market will start to favor you. The market is not a respecter of persons. It will reward you when you do the right thing.

Fore more information about Jeff Greenblatt, visit Lucaswaveinternational.com.