The country is as split as it has ever been. On Inauguration Day, half the country was glad while a good portion of the other half still had the delusion the Royal Canadian Mounties were coming to the rescue. It was incredible to observe, explains Jeff Greenblatt of Lucas Wave International.

How does this relate to trading? One of my recurring themes here each week is to be sure you are working with the best possible information. It's imperative traders work with the best information possible. If you don’t, the person on the other side of your trade most certainly will.

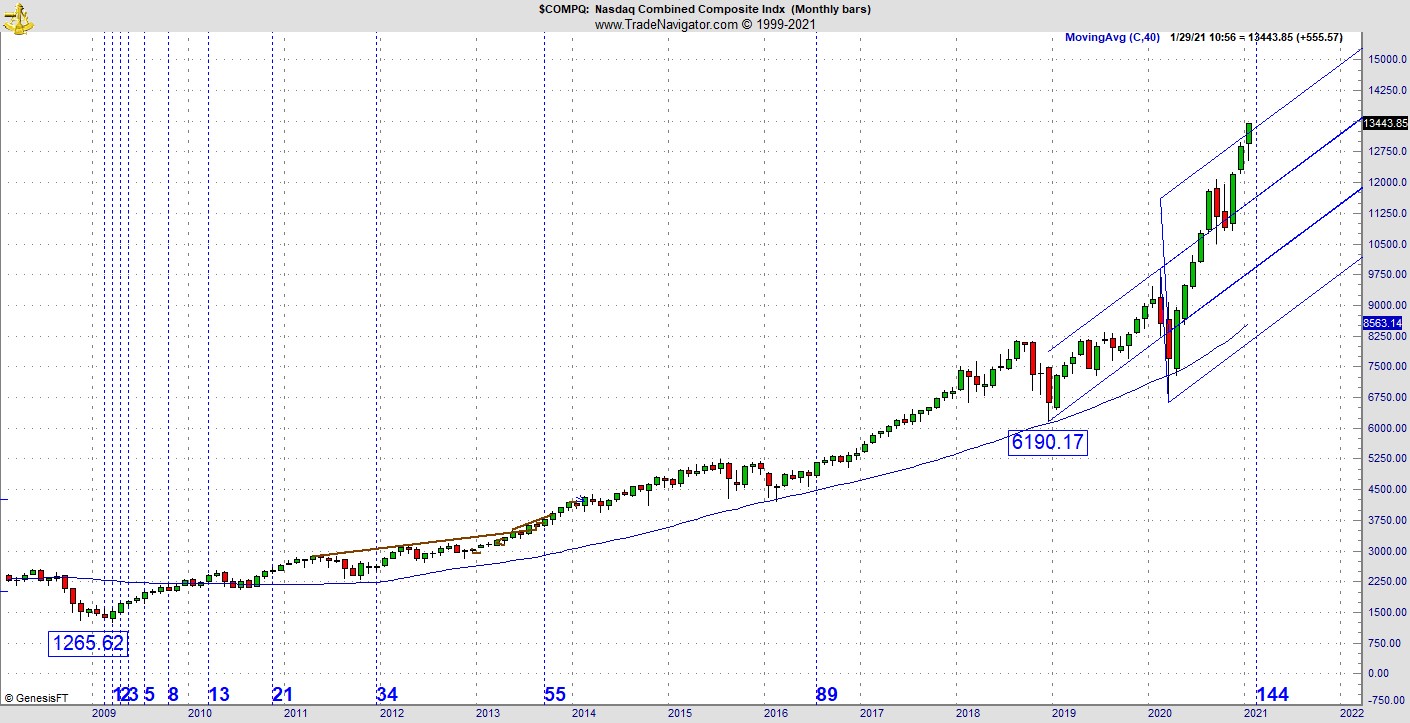

It’s germane to us today because extraordinarily little happened to upset the market. Yet others predicted the market would fall by thousands of points if Biden were seated. We even had a 618-week window off the 2009 bottom. All have failed to stop this stimulus-fed market. There are two things that need to be addressed here. Why is the market higher and what is the next time window?

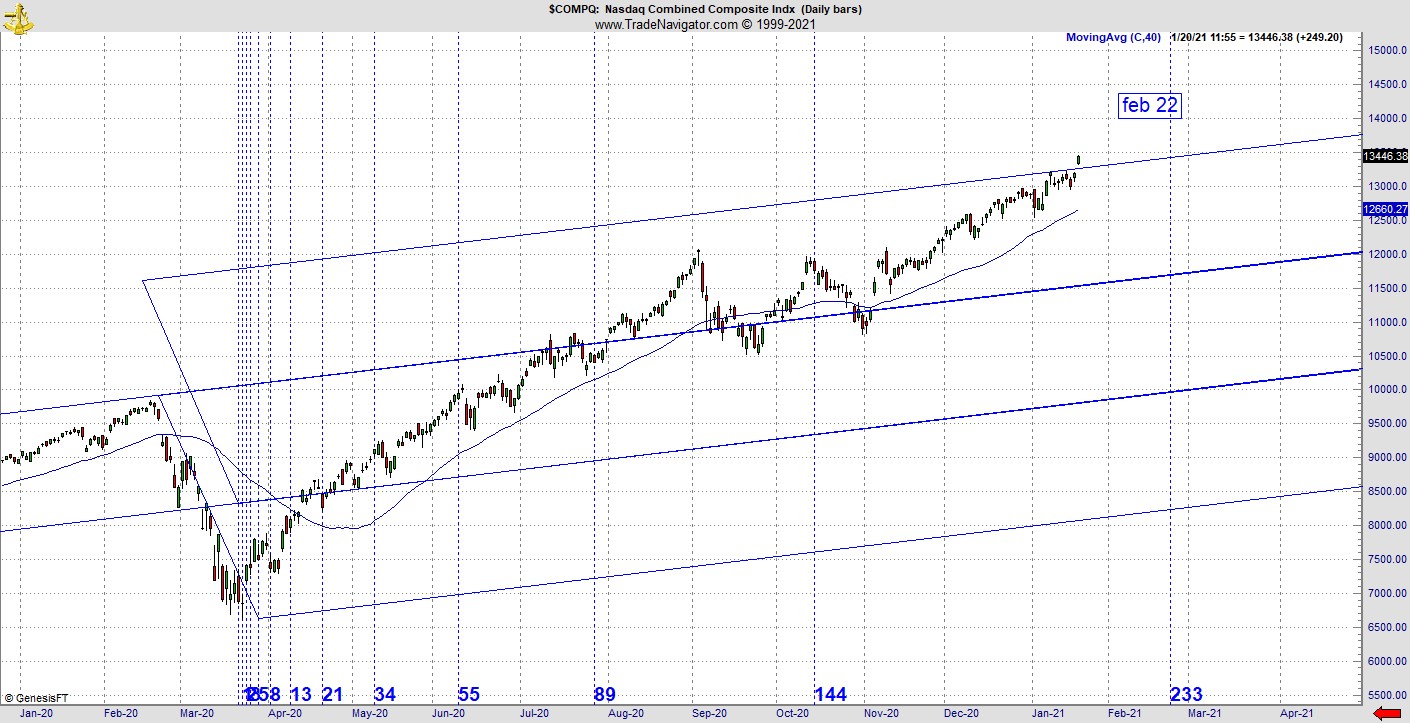

Let’s talk about the time window next. For those who are new to cycle work, a pattern does not have to confirm a specific window. The reason we pay attention to such points in time is because conditions turn ripe as does risk. Markets don’t have to turn, but they could. February can be interesting because it will be 144 months off the bottom, but also February 22 is the 233rd trading day since the low last March. If something were to happen prior to that, it would only be because something else that we don’t yet know squares out.

The market cheers the new administration because incoming Treasury chief Janet Yellen is on a similar page to get more stimulus into the hands of Americans. Among other things, Biden is calling for the American people to get the difference of $1,400 per person so everyone does end up with the $2,000 discussed a few weeks ago. With majorities everywhere in Congress, this is likely to get done sooner as opposed to later. Whatever else you might think of what went down in terms of this election, the market only appears to be focused on the Fed and Treasury to flood the economy with more money.

MoneyShow’s Top 100 Stocks for 2021

The top performing newsletter advisors and analyst are back, and they just released their best stock ideas for 2021. Subscribe to our free daily newsletter, Top Pros' Top Picks, and be among the first wave of investors to see our best stock ideas for the new year.

Markets rarely go down in a season of financial stimulus. In my years of trading the only time I saw markets go down during an easy-money period was during the Internet bear in 2001. I’ve shared with you how I was short a basket of stocks on the first trading day of 2001 when Greenspan called for a rate cut between Fed meetings. Stocks soared sky high yet several weeks later all the gains were retraced.

Here’s the other reason the market did not drop as of now. There was no black swan event. I’ve heard everything from the US being invaded by China to patriot militia groups not allowing Biden to get seated. All I can do is work at connecting the dots and waiting until the dust settled.

Elsewhere, the US dollar rallied almost on cue. Why did I tell you the greenback was remarkably close to lifting off? After it found the low and started turning up it accelerated on the 288th vibrational day of the year. Keep in mind vibrations that line up with 144 could work on the greenback given the fact the top in 2020 came in on its 144th month since the 2008 bottom.

This is keeping gold in check as it continues to consolidate in its retest of the 2011 prior all-time high. I suspect the greenback still has more upside to go while the precious metals continue to consolidate. In the bigger picture I suspect gold to be much higher while the greenback ends up much lower. Before this is done, I suspect the dollar will retest the 2011 bottom in the low 70s.

Unless there is a black swan, which is now the lower probability, it’s time to watch for signs of Congress passing new stimulus because we could be playing a game of buying the rumor and selling the news.

Fore more information about Jeff Greenblatt, visit Lucaswaveinternational.com.