This really happened. From March to August 2020, many of the large-cap technology stocks were on fire, explains Alan Ellman of The Blue Collar Investor.

Thor shared with me a covered-call trade he executed with Amazon.com, Inc. (AMZN) where the strike moved $1,000 in-the-money (ITM) as share price headed to the moon. As you read this article, see if you can find lessons to be learned.

Thor’s Trades

- 4/16/2020: Buy AMZN at $2,093.00

- 4/16/2020: STO the 1/15/2021 LEAPS $2,100.00 call for $89.00 ($8,900.00 per-contract)

- 8/28/2020: AMZN trading at $3,402.00

- 8/28/2020: The cost-to-close (CTC) the $2,100.00 call is $1,356.80 per -share

- 8/28/2020: The time-value CTC is 2.6% (use the “Unwind Now” tab of the Elite or Elite-Plus Calculators)

AMZN Chart from April Through August 2020

AMZN Chart Showing Thor’s Trade

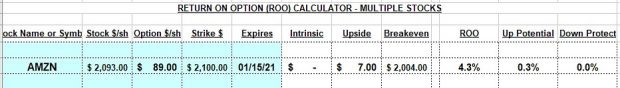

Trade Structuring Using the “Multiple Tab” of the Ellman Calculator

AMZN Initial Calculations

The nine-month 4.3% initial time-value return annualizes to 5.7%.

Should We Close the Trade Now?

When a strike moves deep ITM, the time-value component of the option moves closer to 0. In this case, the CTC is 2.6% but in order to close one contract, we must invest an additional $135,680.00…yikes! To determine if this an appropriate action for a robust portfolio, we then ask ourselves if we can generate more than 2.6% by contract expiration, which is still more than four months away. The answer is yes we can. If we cannot take this action, we continue to monitor the trade for potential other exit strategy opportunities.

Lessons Learned

We all benefit from analyzing our trades…how could I have done better? We never stop learning. From these trades, here are my lessons learned:

- By using an expiration date months away, we are adding additional risk by trading through multiple earnings reports

- Longer-term options generate lower annualized returns

- Shorter-term options allow us to re-evaluate our bullish assumption on a frequent basis

Discussion

We all become better investors and traders by analyzing our trades. I do this to this day and will continue as long as I invest. We never stop learning. In this case, Thor learned some valuable lessons while achieving his maximum return as the trade was initially structured. Next time, his returns will be even higher.

Learn more about Alan Ellman on the Blue Collar Investor Website.