US equity markets regained some composure to close out last week as President Biden’s capital gains tax proposal was digested, explains Ian Murphy of MurphyTrading.com.

In the week ahead, more of the tax plan will be revealed but according to the Tax Foundation, New Yorkers and Californians could be facing marginal rates of 58.2% and 56.7% when state level taxes are added.

Reviewing podcasts over the weekend, the inflation debate is front and center while head scratching cryptocurrency valuations and the deluge of Special Purpose Acquisition Companies (SPACs) are hot topics. There continues to be a consensus that too much money is chasing too few opportunities and fundamental valuations are being ignored in the process.

Eqquity futures are mixed. The tech-focused Nasdaq is trending down while the Russell, which tracks 2000 mid-sized firms is going the opposite way.

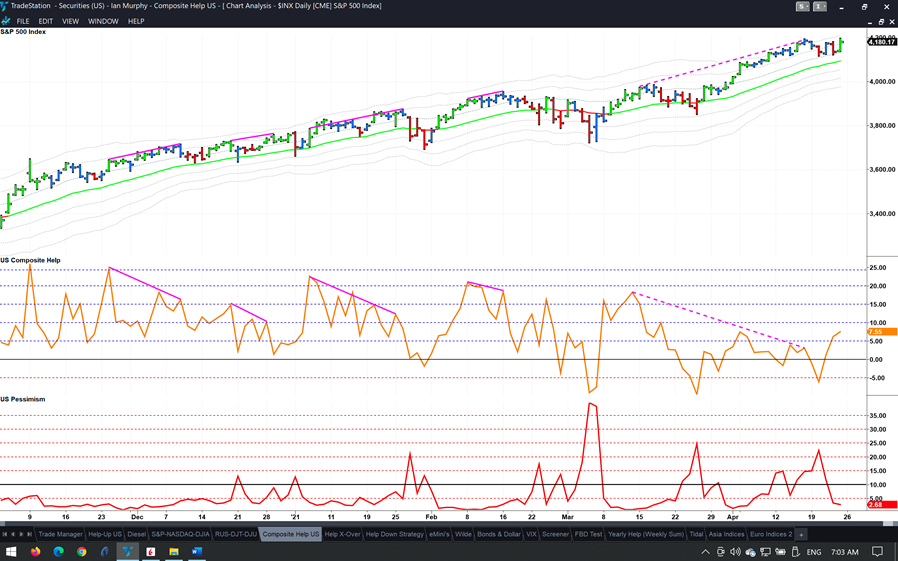

Composite Help recovered somewhat as pressure was released last week and it remains to be seen if this is enough to keep Pessimism below 10%.

Trailing stops on the positions discussed recently have all flatlined. Because the stops are calculated from lows of price bars, a move up on stops this week will reveal more about the market’s underbelly than another “all time high” which would most likely grab the headlines.

Stay safe and trade safe!

Learn more about Ian Murphy at MurphyTrading.com.