The big banks got earnings season started last week with more to follow, writes Ian Murphy of MurphyTrading.com.

According to Refinitiv, only 35 firms in the S&P 500 (SPX) had reported by Friday so we can expect the pace of announcements to ramp up significantly in the week ahead.

On Thursday the European Central Bank (ECB) is set to reveal the first interest rate hike for the Euro Zone in the current cycle, and Fed officials have entered an information blackout period before their decision next week where a 100-basis point increase is now a real possibility.

It would be an understatement to say plenty is going on in equity markets and tensions are running high.

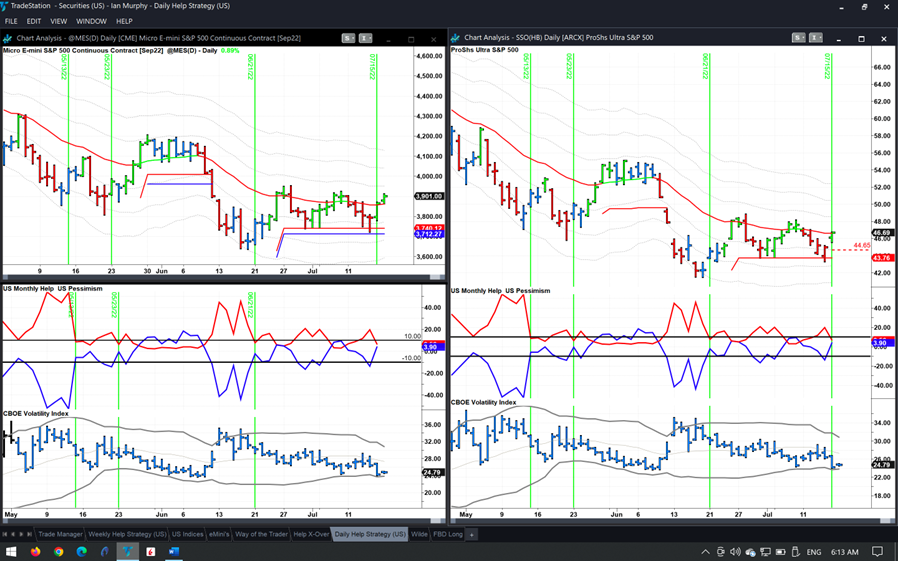

Click the chart to enlarge

Following last week’s presentation on how to trade the Help Strategy in bull and bear markets, it was wonderfully ironic to see another trigger occur right on the EMA line on Friday. Technically we are in a bear market so we should sit this one out, but it was a picture-perfect trigger and if the bear market is ending this could be the most profitable trigger of the year. What to do?

There are no perfect solutions in trading, just opportunities that carry risk, and we must decide which ones to take. Friday’s trigger was a perfect reminder of that.

For those who did enter the trade, the initial protective stop is at $44.65 on ProShares Ultra S&P500 2x Shares (SSO) as shown with the dashed red line above, and you should be scaling out after a 1ATR move to the upside if there is one.

Learn more about Ian Murphy at MurphyTrading.com.