The world’s central bankers wound up their annual shindig at Jackson Hole on Saturday but not before Jerome Powell said the Fed is, “prepared to raise rates further if appropriate,” states Ian Murphy of MurphyTrading.com.

Lagarde of the ECB followed suit saying borrowing costs will remain high until inflation returns to their illusive 2% target. There was nothing new in these statements other than a reminder that the fight against decades-high inflation is far from over. In the week ahead, Thursday brings the latest inflation data in the US and EU, while nonfarm payrolls are due on Friday in the States. UK markets are closed for a bank holiday today.

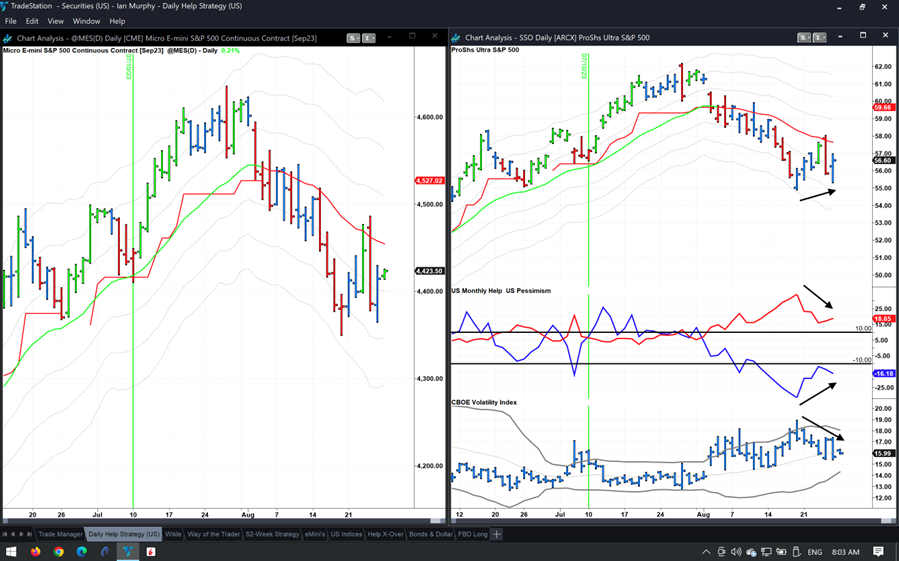

Meanwhile, on the charts, the Help Strategy may trigger again this week, and possibly as soon as today. The Pessimism and Help indicators are heading in the right direction, while the Cboe SPX Volatility Index (VIX) is falling (arrows). If we do trigger it will likely form a first higher low pattern on the -1ATR line.

Learn more about Ian Murphy at MurphyTrading.com.