The main theme for investors right now is how the surge in bond rates made stocks less attractive, states Steve Reitmeister of Reitmeister Total Return.

I am not the only investor fixated on this topic. Howard Marks, the famed money manager from OakTree, believes this theme has multiyear effects on the investment landscape. That is a topic we need to dig into further today. Spoiler Alert: It does darken the appeal of stock investing going forward. The good news is that those aware of the Sea Change can chart a course to outperformance. And that is exactly what we will discuss today.

The simplified version of the current investment chain reaction goes like this:

Bond Rates Up > Stocks Down

However, that is just the current dynamic.

Bond Rates Up > Lower Corporate Borrowing > Slower Economic/Earnings Growth > Stocks Less Attractive > Bonds More Attractive

Why are stocks less attractive?

Because earnings growth is the main catalyst for stock price appreciation. This means that once stocks become fully valued in terms of PE...then really the only thing that makes sense to move prices higher is earnings growth. If that is muted...so too is upside potential.

Further, if bond yields are higher, then investors have a very attractive, lower-risk alternative to achieve decent rates of return. This dynamic has already been set into motion given the dramatic rise in rates since the spring and accelerated the past couple of months.

Note that stocks being less attractive does not equal unattractive. And does not mean bearish.

In essence, it says that investors need to throw out the playbook from the last 40 years as interest rates dropped from historically high levels in the early 1980s to artificially low levels between the Great Recession and the Covid crisis. (See chart below).

Once ten-year Treasury rates got under 2%, the playbook was all about TINA: There Is No Alternative...to buying stocks.

This means that with interest rates at historic lows, at some point rates would move higher...which hurts bond prices...making bonds a very unattractive investment.

This shifted most asset allocation models to very high percentages in stocks. This helps explain the longest bull market in history from the end of the Great Recession through Covid (but not unfair to say the three-week bear market in March 2020 barely counts as stocks continued to rise to new heights through the end of 2021).

Again, Howard Marks is saying that the normalization of rates will make bonds more attractive once again and thus stocks less attractive. Yet he goes on to say that those with a superior method of stock selection, especially with an eye towards value, will have a decided edge in the stock market.

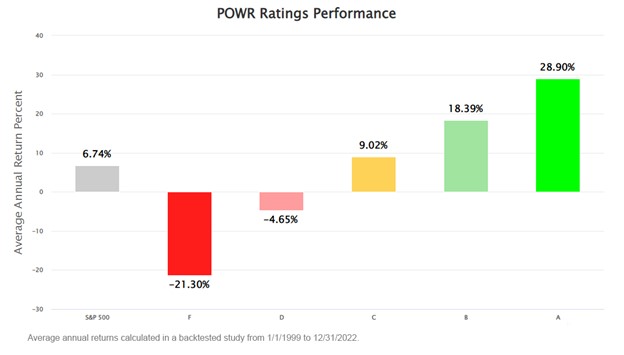

Do you know what I am going to say next... our POWR Ratings model focusing on 118 factors that point to stocks outperforming is a decided advantage in our favor. On top of that, there is most certainly a value bias in our approach given that 31 of the factors are in the value camp.

Once again, do not take this as a bearish statement from Marks. It is a fair and accurate assessment of the new landscape...which is more akin to historical investment landscapes where higher bond interest rates are an attractive alternative to stocks.

This also explains why I have added bond investments to my newsletter portfolio for the first time since I started doing newsletters back in 1998. On top of that is a strategic allocation to stocks packed to the brim with the outperforming characteristics of the POWR Ratings. That was certainly beneficial today as our portfolio generated a solid return even as the S&P 500 was modestly in the red.

Price Action & Trading Plan

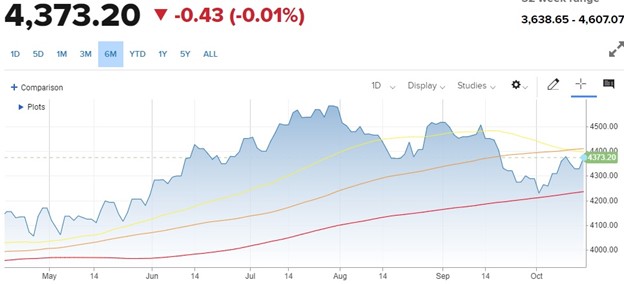

Moving Averages: 50 Day (yellow), 100 Day (orange), 200 Day (red)

It appears that stocks found ample support as we approached the 200-day moving average at the start of October. From there the market has bounced around 4% from recent lows and not taking a run at both the 50 and 100-day moving averages.

Hard to call it overly bullish. Nor is it super bearish. Instead, it is rather volatile as the big up-and-down swings make it hard to feel comfortable in the current environment. Yet given that the economy is still growing (most estimates north of 3% for Q3) and employment is still solid, then much easier to appreciate the long-term picture and leans bullish.

In the short term, we are enduring the realignment to this new world order thanks to higher rates. This may lead to a few more painful periods for stock investors before things settle in. Yet all in all, when you appreciate the fundamental and technical picture, it is still appropriate to be fully invested at this time for whenever the next leg higher ensues.

The key is where to invest. The above conversation helps to strategize that plan. And the section below provides more specifics on the best ETF and stock investments for the time ahead.

Learn More About Reitmeister Total Return here…