US consumer prices edged up a notch in November, but the rate of increase has fallen dramatically, and it looks increasingly like Powell & Co at the Fed will pull off a ‘soft landing’ for the US economy, states Ian Murphy of MurphyTrading.com.

Not only will this Holy Grail for central bankers look good on Jerome’s resume, but it will also pave the way for interest rate reductions next year with analysts predicting the first shallow cut from Q2 onwards.

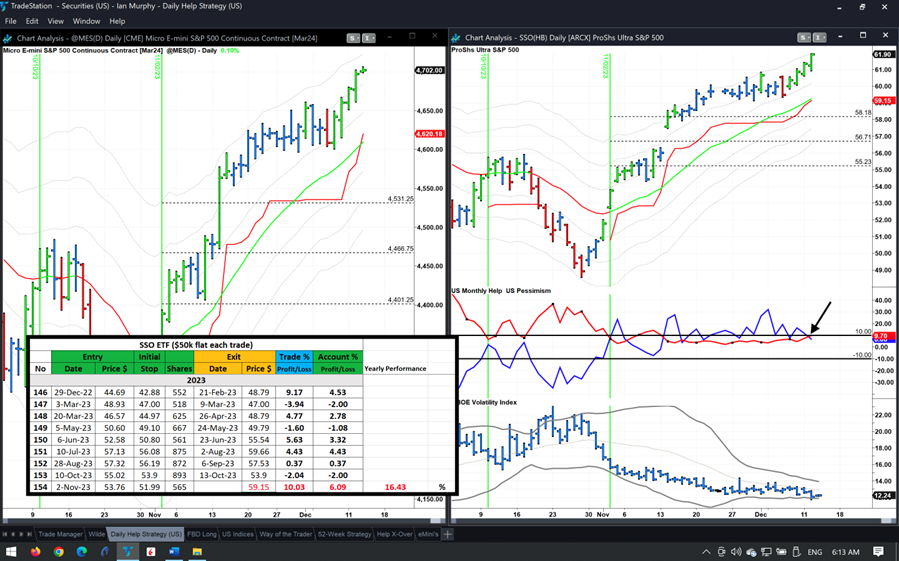

The Pessimism indicator didn’t like the news and shot up to 9.7% by the time US equity markets closed (arrow). It’s possible this has to do with some profit taking and I wouldn’t panic just yet as the current Help trade is up 15.14% on SSO and 7.16% on Micro E-mini futures. Even if we get a severe pullback from here, 10.3% is already locked in on the ProShares Ultra S&P500 2x Shares (SSO) trailing stop (spreadsheet).

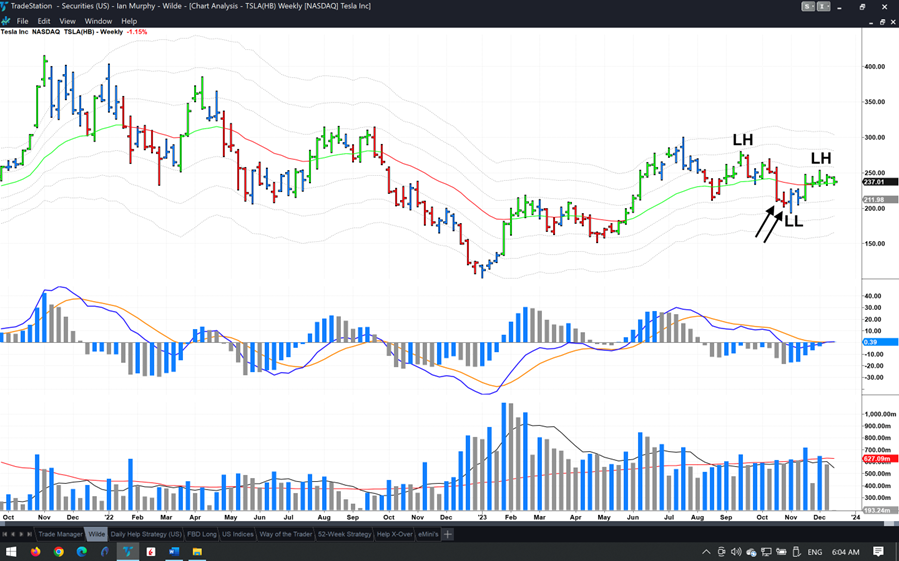

In stock-specific news, James has asked about Tesla (TSLA) and if the recall on two million vehicles issued this morning will impact the price. The electric car maker has been in a downtrend since September when the price made a lower high on the weekly chart above. There were also two exit signals in October on consecutive weeks (arrows).

In pre-market trading, the stock was off over 1% at 6 AM ET, but I can’t see why someone following my suggested exit signal of a close below the -1ATR line would be in this stock.

Learn more about Ian Murphy at MurphyTrading.com.