Black Gold is next up in the Commodity Supercycle. It's not about war. This is a long-term trend. Here’s why to consider names like Exxon Mobil Corp. (XOM), explains JC Parets, founder of TrendLabs.

Crude oil and energy stocks ripped higher last week. In the news, they might tell you it's because of turmoil in the Middle East. As usual, I think everybody's wrong. Let's talk about what's actually happening.

First of all, asset prices trend. When an asset is rising in price, there is a much higher likelihood the asset will continue to rise in price rather than completely reverse and head in the opposite direction. We know this. We have the data. It's just math.

Here's something else that we know: Commodity Supercycles don't last for just a couple of years. They last for decades. The first one to go is gold. Last year, gold prices broke out in US dollar terms, and we've been seeing new all-time highs every single quarter since.

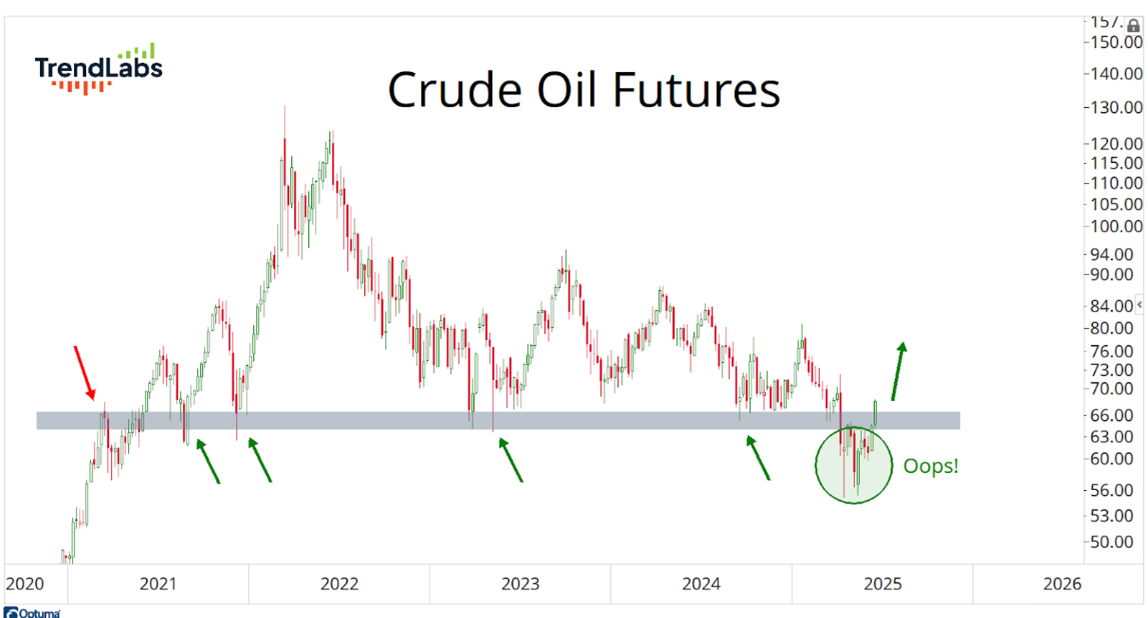

But don't miss copper hitting new all-time highs this year as well. Which major commodity and contributor to the Supercycle is next? Crude oil. Short sellers in energy overstayed their welcome. And now they're suffering the consequences.

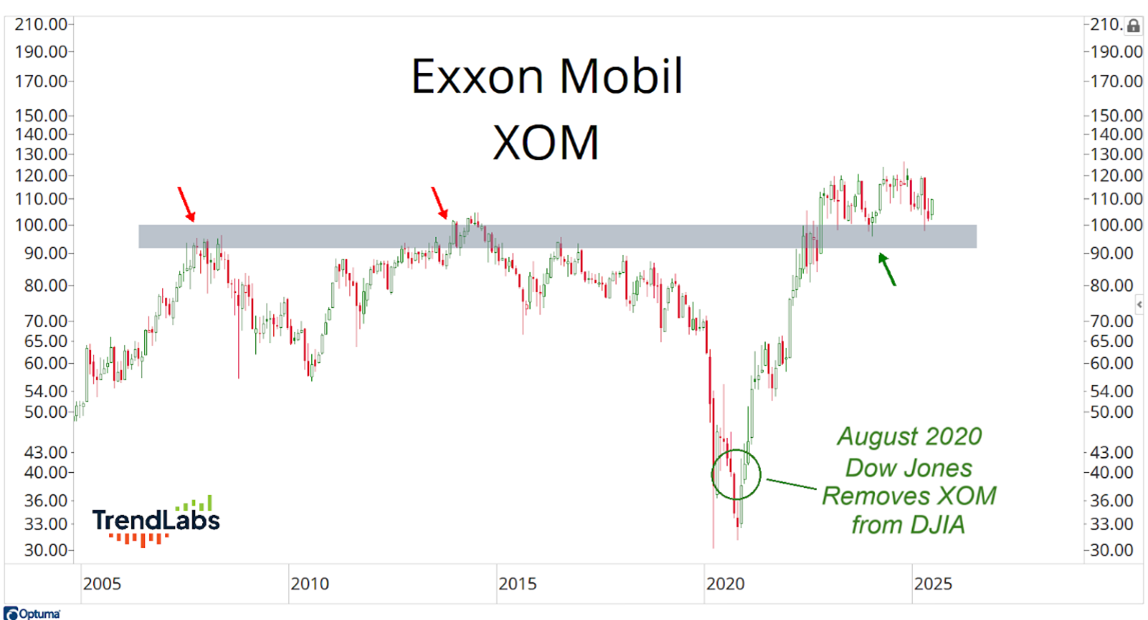

One thing I really like about this energy trade is Americans simply don't own enough of it. That's why we've been increasing our energy exposure over the past few weeks, buying more energy stocks and options.

Investors who own the S&P 500 are only getting 3% exposure to energy, near a historic low weighting for this benchmark index. Investors who own the Dow Jones Industrial Average are actually getting less than 2% energy.

Remember, they kicked XOM out of the Dow a few years ago…just before the stock went on to triple in price. And I think this move is just getting started.

The worst thing that could happen to some is a spike in oil prices and a historic rally in energy stocks. So, that's what we're betting on.