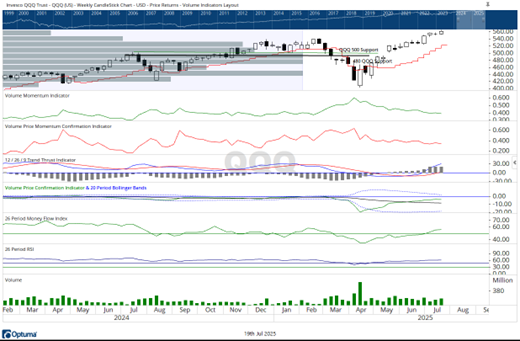

The market continued its upward ascent this past week, with the generals once again leading the charge. Yet the broader campaign showed signs of waning fatigue. The generals – the Invesco QQQ Trust (QQQ) – pressed ahead, gaining 1.3% and pulling their lieutenants – the SPDR S&P 500 ETF (SPY) – slightly higher by 0.6%, highlights Buff Dormeier, chief technical analyst at Kingsview Partners.

Volume was light, and participation thinned, suggesting that while leadership remained intact, the ranks behind it were less committed to the current advance. The Invesco S&P 500 Equal Weight ETF (RSP) slipped into slight retreat, closing the week down 0.1%. The iShares Russell 2000 ETF (IWM) managed a small advance of 0.3%.

This week’s action paints a mixed battlefield. The mega-cap trade has returned to prominence, while broader equity leadership has faltered. Although overall volume was subdued, upside volume and capital inflows still outpaced their downside counterparts by a nearly two-to-one margin. This bullish action continues to push accumulated Capital Weighted Volume and Capital Flows into new all-time highs, well ahead of price.

However, not all signals confirmed the move. The NYSE Advance–Decline Line posted its second consecutive weekly decline, a subtle sign that the market’s earlier broad-based formation can be fragmented. With fewer battalions participating in the charge, the risk of overextension grows.

A narrow advance, even when led by strength, carries risk when not supported by the wider formation. Discipline becomes critical as capital flows continue to lead price into new territory. Consider maintaining your position, but with tightened formations. Protect gains, assess exposure, and remain prepared to adjust should the market’s support lines give way.