Despite the powerful move since late 2022, certain market breadth measures are not showing the consistent strength we typically see. Meanwhile, Darden Restaurants Inc. (DRI) looks attractive after pulling back to its 10-month exponential and bouncing, advises John Eade, president of Argus Research.

Some 61% of S&P 100 stocks are above their 200-day average, down from a peak of 85% in December 2023. Those above their 50-day have fallen to 44%. On the positive side, the advance-decline (AD) line for the index is very close to an all-time high, and the AD line for volume also is near an all-time high.

(Editor’s Note: John will be speaking at the 2025 MoneyShow/TradersEXPO Orlando, scheduled for Oct. 16-18. Click HERE to register.)

Data by YCharts

As for Darden, it is a leading US restaurant operator, with more than 1,900 restaurants operating under the Olive Garden, Ruth's Chris, Cheddar's Scratch Kitchen, Bahama Breeze, Seasons 52, Capital Grille, Longhorn Steakhouse, and Eddie V's names.

Excluding the pandemic, DRI has been a consistent winner since a 2009 low at $7. The stock has received support from its 10- and 21-month exponential averages. The stock traded sideways for a while between $133 and $177 until December 2024, when it broke out.

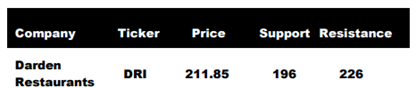

After peaking on Feb. 6, the stock fell to its 21-week exponential, bounced, tested its lows in April, and popped to all-time highs. Now, we would put a stop-loss just below chart support at $196. We would take profits at $228.

Recommended Action: Buy DRI.