What inning are we in for the AI revolution? We have heard many answers, but little consensus. Outside of tech, GE Aerospace (GE) looks attractive from a technical perspective, writes John Eade, president of Argus Research.

GE is a global aerospace propulsion, services, and systems leader, with an installed base of about 44,000 commercial and 26,000 military aircraft engines. GE has been benefiting from supply-chain improvements and product innovation.

GE Aerospace (GE)

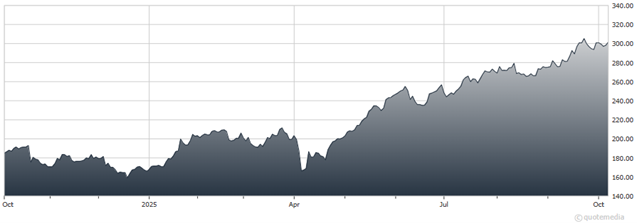

It began trading as an independent public company in April 2024, but kept the GE ticker. As such, the chart goes back to 1962. But we will look at the chart only from April 2024.

During its first year, the stock traded sideways with a slight upward slope. In April 2025, the shares took off from the $167 level, surging to $256 by June 6. From there, GE crawled higher, tracing out a series of higher highs and higher lows, and topping out at $280 on Aug. 12.

The stock then formed a small cup, breaking out to all-time highs in mid-September. After peaking on Sept. 23 at $306, the shares have traced out a bull flag. We would put a stop-loss just under chart support at $276. We would take profits at $320, with the potential for larger long-term gains.