All it took was two words. Two words from Federal Reserve Chairman Jay Powell to send 2-year Treasury Note yields surging. So...what should traders do?

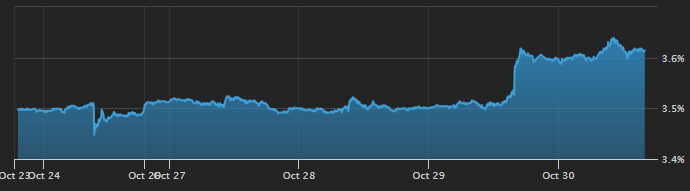

We’ll get into that in a minute. But first, take a look at the MoneyShow Chart of the Day, which shows the one-week change in 2-year yields. You can see the 2-year was yielding 3.5% late last week. But it shot up to 3.62% on Wednesday and remained elevated yesterday.

Source: Wall Street Journal

Why did that happen when the Fed cut the federal funds rate by 25 basis points? Because Powell said it was “far from” certain the Fed would follow this week’s cut with another one at the policy meeting that concludes Dec. 10.

Since the 2-year yield incorporates expectations about future Fed moves – and expectations for a December cut were high – the surprise remarks caused yields to spike. That, in turn, fueled fresh volatility in several corners of the capital markets.

So, what should you do? Don’t panic. But DO keep an eye on the bond market to see if we get more follow-through at the short end of the curve.

If yields keep rising, it will likely give the dollar a boost...restrain any rebound in precious metals prices...AND put pressure on high-growth, high-valuation stocks (Big Tech, I’m looking at you!)

The last of those three consequences could be especially important. After all, a ton of money is invested in the tech sector. Plus, we’ve already had questions swirling in the markets about the sustainability of AI spending – and some AI stocks swooning in response. The last thing the group needs is another hurdle to jump over.