The three major US stock indices were all lower on Wednesday, but cut their losses in late-day trading. Overall, US stocks have backed off from all-time highs amid growing geopolitical tension and concerns about Fed independence, advises Brian Kelly, editor of MoneyLetter.

In addition, last week’s call by President Trump for credit card reform has put pressure on bank stocks. Bank of America Corp. (BAC), Citigroup Inc. (C), and Wells Fargo & Co. (WFC) are off about 6%-7% this week.

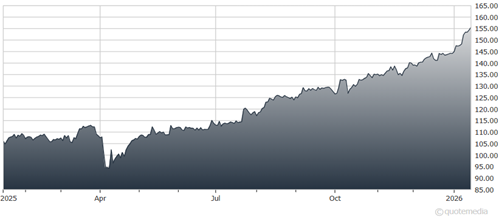

POGRX, NEAGX (1-Yr % Change)

Data by YCharts

Interestingly, our global stock markets were all higher for the one-week reporting period. From Jan. 8 through Jan. 14, the S&P 500 eked out a 0.1% gain; the Euro Stoxx 50 gained 1.4%; the Nikkei 225 surged 4.6%; and the Shanghai Composite advanced 1.0%.

There were several changes made to the model strategies last week. These trades are designed to upgrade performance and bring our model strategies into better alignment with the target asset allocations.

In the MoneyLetter Venturesome, we bought PRIMECAP Odyssey Growth Fund (POGRX) and the Needham Aggressive Growth Fund (NEAGX). POGRX invests primarily in US common stocks, emphasizing those companies with the potential for above average earnings growth. NEAGX invests principally in markets and industries with strong growth potential, focusing primarily on the market leaders in these areas as these companies often garner a disproportionate share of the positive financial returns.

Recommended Action: Buy POGRX and NEAGX.