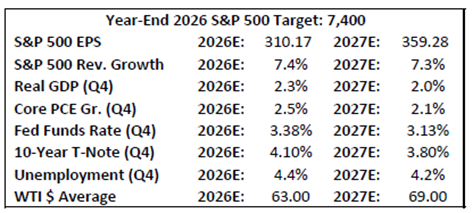

With numerous headlines causing confusion, the weight of evidence still favors the bulls and the S&P 500 Index (^SPX). What we have currently is flat intermediate-term demand coupled with contracting supply, observes Sam Stovall, chief investment strategist at CFRA Research.

This is normally enough to keep prices on an upward trajectory, but only a meaningful increase in demand can break the market out of its range. Our OCO Cumulative and NYSE all-issues Advance-Decline lines provide evidence of broad-based participation as each registered their own new all-time highs on January 22.

This is not to say that the market is impervious to short-term pullbacks. But typically, it takes many months of breadth deterioration while the major price indexes continue to rise before a peak. Until signs of selectivity emerge that lead to negative divergences in many of our key measures versus price, the probabilities suggest that the market moves higher ahead.

Still, the technology sector continues to take it on the chin, led by a sharp selloff in software stocks amid renewed fears that AI companies are coming for their businesses. The catalyst? Anthropic’s Claude Legal Plugin and expanding enterprise tools that automate everything from contract review to coding.

However, CFRA equity analysts point out that the S&P 500 Systems Software index’s forward P/E has compressed 17% year-to-date, despite little evidence of actual market share loss. Also, leading components just reported solid AI-driven growth with resilient demand. We think that as customers adopt more AI-powered workflows from their existing SaaS vendors, they become more entrenched, not less.