Valued at $7.9 billion, Clearway Energy Inc. (CWEN) owns, operates, and acquires renewable and conventional generation and thermal infrastructure projects. Since our Trend Seeker tool issued a new “Buy” on Jan. 16, shares are up 9%, advises Jim Van Meerten, analyst at Barchart.

The company also offers natural gas and dual fired, solar and wind generation and distribution services. It serves commercial businesses, universities, hospitals, and governments. The stock checks boxes for the highest technical buy signals and superior current momentum in both strength and direction.

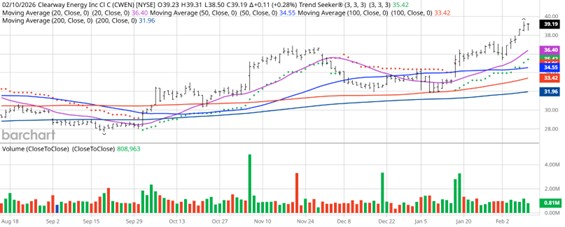

Clearway Energy Inc. (CWEN)

Clearway Energy scored a three-year high of $39.62 on Feb. 11. It has a Weighted Alpha of +52.1 and a 100% “Buy” opinion from Barchart. Its Relative Strength Index (RSI) is at 72.4 and there’s a technical support level around $38.69.

The Wall Street analysts followed by Barchart give the stock nine “Strong Buy,” one “Moderate Buy,” and two “Hold” opinions, with price targets between $34 and $50. CFRA’s MarketScope rates the stock a “Buy.” Morningstar also thinks the stock is 7% undervalued.

Recommended Action: Buy CWEN.