This COULD be the year of the mega-IPO – with top Artificial Intelligence (AI) companies and SpaceX eyeing 2026 public market debuts. But the performance of past Initial Public Offerings is souring, raising questions about investor enthusiasm for big deals.

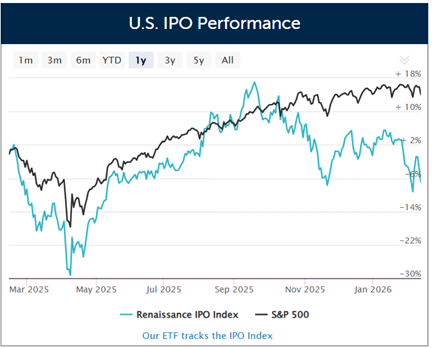

My MoneyShow Chart of the Day shows the performance of the Renaissance IPO Index and the S&P 500 Index (^SPX) over the past year. The former tracks companies that have gone public within the last three years, and that have also met standards for size, liquidity, and free float.

Source: Renaissance Capital

You can see that the IPO index generally tracked, or even outperformed, the S&P until September. But it has notably underperformed since then. It’s now down 6.9% in the last 12 months, while the S&P is up 14% over the same stretch.

Looking back at 2025, it was a great year for issuance. A total of 202 companies raised $44 billion in the public markets, up sharply from 150 companies and $29.6 billion in 2024. That was also the highest tally in four years.

But SpaceX alone wants to raise up to $50 billion in its IPO. The company is reportedly eyeing a summer debut. ChatGPT-maker OpenAI could seek as much as $60 billion. Claude’s inventor Anthropic just raised $30 billion in a private funding round. So, its IPO would be another blockbuster...if it happens in 2026, that is.

Will enough investors be eager to throw money at those deals? Especially when past deals aren’t working out? AND when worries about AI capex spending – and AI-driven disruption of various industries – are rising?

No one knows the answer. But deal bankers and company officials better hope shares of past IPOs perk up. Because if they don’t, timelines could get pushed or offerings could get downsized.

As for what it means to investors NOW? Consider reallocating some money to other sectors that are performing better. It’s no longer an “All Tech, All The Time” market after all!