The AI-blamed selloff started with the software industry, triggering renewed fears that AI companies will adversely affect their businesses. Then the sector version of Whac-a-Mole kicked in, initiating “rolling corrections,” notes Sam Stovall, editor of CFRA Research.

Those impacted groups like transportation, wealth management, insurance, and commercial real estate in succession, causing traders to wonder, “Where next?”

CFRA analysts caution investors against getting caught up in the emotional instability generated by these selloffs. They remind us that AI will indeed offer cost savings from increased efficiencies and depth of analysis. But these should aid companies by making them nimbler and more profitable.

Today, the equity markets are going through a much-needed digestion of gains. But like an eventual gold medal winner that trails at mid-race, the S&P 500 Index (^SPX) could still close the gap and record its second monthly gain in 2026. Historically, an S&P 500 price increase in both January and February since World War II led to an average full-year total return in excess of 24%, along with a 100% frequency of advance.

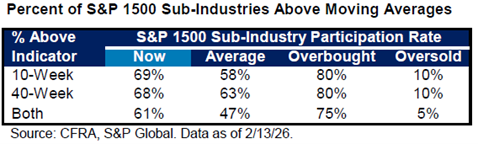

Meanwhile, last week saw a slight slippage in the week-ending percentages of the S&P 1,500 sub-industries trading above their 10- and 40-week moving averages, as well as above both averages. All three readings remain above their long-term averages, though.