How much is TOO much when it comes to AI capex? That’s a question everyone on Wall Street has been asking. New survey data suggests worries are growing – big time!

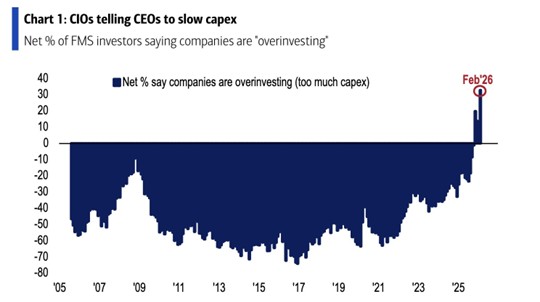

Take a look at my MoneyShow Chart of the Day, which shows data from the latest Bank of America Global Fund Manager Survey. The bank polls investment managers about various topics on a rolling basis. Those managers control enormous pools of capital – around $440 billion in assets under management (AUM) in the latest February survey.

Source: BofA Global Fund Manager Survey

You can see that a whopping 35% of respondents said companies are over-investing now. That’s the highest reading in two decades of data-keeping! Roughly one in four managers also cited an “AI Bubble” as the biggest tail risk for equity markets.

Considering the amount of money being borrowed and spent on data centers, tech hardware, power grid infrastructure, and other equipment, the nervousness is understandable. Just five companies – Microsoft Corp. (MSFT), Alphabet Inc. (GOOGL), Amazon.com Inc. (AMZN), Meta Platforms Inc. (META), and Oracle Corp. (ORCL) – plan to spend as much as $690 billion on capex in 2026, according to The Futurum Group. That’s almost double the level of 2025.

If you’re a tech stock investor or trader, you have to keep your eye on this. Tech stocks have been taking on water all year long, while other sectors have been picking up the performance torch. If you want to stay ahead of the markets, you may need to freshen up your own portfolio!