We’re always going to have our eyes peeled for new, dynamic growth situations, but given the bifurcated environment, we’re also looking for names outside of traditional growth areas, asserts Mike Cintolo, editor of Cabot Growth Investor.

One idea is old friend Blackstone (BX), a stock we rode for a bit last year (sold for a tiny profit) and that has set up a big launching pad in recent months.

The company is one of the biggest and best bull market stocks out there, with a total of $538 billion of assets under management invested in real estate, private equity, hedge fund solutions and credit/insurance products.

Cash generation has been solid for a while (fee-related earnings, which are more stable than one-time realizations, rose 25% in Q1, thanks in part to fee-earning assets rising 20%), which has led to growing dividends ($1.97 per share during the past year, yield of 3.5% — and Blackstone is a C-Corp. now so dividends are qualified).

While virus-related economic disruptions hit asset prices (analysts see earnings down some in Q2 and Q3), Blackstone is really a play on the economic recovery, especially as the Federal Reserve floors the accelerator.

If the global economy comes back and key areas like real estate strengthen, there’s little doubt the company’s distributable income will continue to surge in the years ahead.

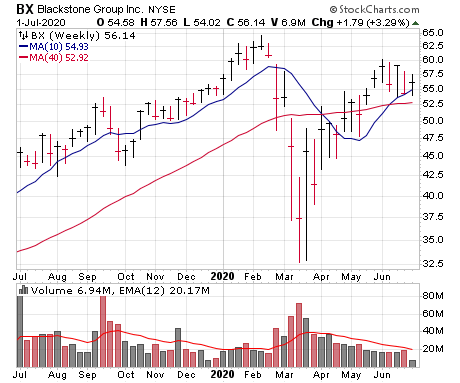

Analysts see next year’s earnings up 42% from this year’s guesstimates. As for the stock, it broke out of a big consolidation last April, had a solid run into February and then gave it all back during the crash.

But the comeback from there has been solid, and the last four weeks have been just what the doctor ordered, allowing BX to catch its breath. If the broad market picks up steam and BX shows some power above 60, we could test the waters again.