A “boombox” was an oversized, battery-powered, portable music machine; it is an artifact of a very particular time in American culture, recalls Tony Sagami, editor of Weiss Ratings Daily Briefing.

Boomboxes are no more because music has become “digitized,” a wondrous process enabled by advances in microchips, aka semiconductors.

Digitization has made it possible for everything electronic to dramatically shrink in size. Indeed, the boombox was initially replaced by the Walkman from Sony Corp. (SNE). Then, the iPod from Apple (AAPL) came along.

The miniaturization boom signaled by the iPod has been fueled by the advances in microchip technology. Semiconductors not only make electronics simpler; they make them faster ... way, way, way faster.

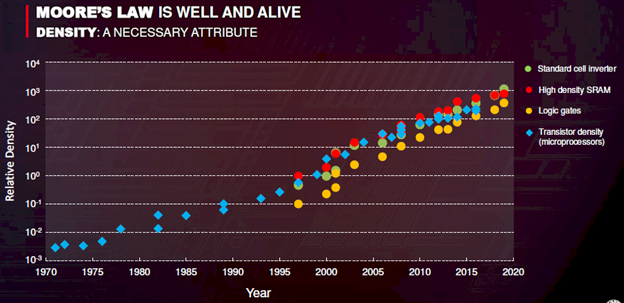

Somewhat lost amid the year’s strange-stranger-strangest string of events is the fact 2020 is the 55th anniversary of Moore’s Law.

Moore’s Law is an observation articulated in 1965 by Gordon Moore, the founder of Intel Corp. (INTC), that the performance integrated circuit boards would double every two years.

That every-other-year doubling has resulted in chips roughly 2 billion times more powerful today compared to those made 50 years ago. That’s 2 billion times more powerful.

This processing-power boom has benefitted not just the electronic industry. Every industry you can think of — manufacturing, engineering, energy, transportation, financial services, aviation, entertainment, agriculture, etc. — has enjoyed dramatic productivity improvements from increased computer processing power.

And the most dramatic improvements are yet to come; I’m talking about artificial intelligence, or AI. There’s a furious race underway between semiconductor manufacturers to design the winning AI chip for data centers, self-driving cars, robotics, smartphones, drones and other devices.

So, which semiconductor stocks will cash in on the AI bonanza? Advances and developments are happening so fast that it’s impossible to identify a single top prospect, but it’s likely the winner(s) will emerge from among Advanced Micro Devices (AMD), Broadcom (AVGO), NVIDIA (NVDA) or Qualcomm (QCOM).

If you’re more of an exchange-traded fund investor, take a look at the ProShares MSCI Transformational Changes ETF (ANEW), the iShares Exponential Technologies ETF (XT) or AI Powered Equity ETF (AIEQ).

Intelligent machines powered by artificial intelligence-specialized semiconductors are going to change our lives, which is why Mark Cuban of “Shark Tank” predicts that “the world’s first trillionaires are going to come from someone who masters this (artificial intelligence).”

Cuban is right; International Data Corporation predicts that spending on artificial intelligence will increase from $50 billion this year to $110 billion by 2024.

Anytime you start throwing the word “billions” around Wall Street, you know someone is going to make a mountain of money. That “someone” could be you if you jump on the AI bandwagon. Best of all, you won’t have to lug around a heavy boom box to enjoy the music.