I'm not an economist and my eyes glaze over when reading "expert" opinions on the impacts that interest rates, quantitative easing, increased money supply, and/or inflationary pressures may have on our economic future, notes Neil Macneale, editor of 2-for-1 Stock Split Newsletter.

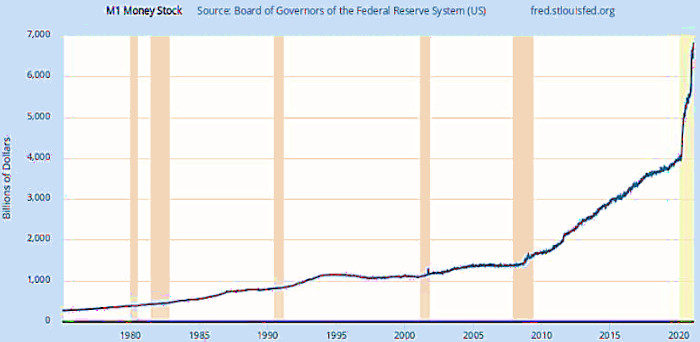

However, one can't help but be alarmed when basic measurements of the nuts and bolts of our economy go completely haywire. A clear example would be the graph below, showing one of the crazy aberrations we have experienced in this time of Covid-19.

The M1 Money Supply includes coins and notes that are in circulation and other money equivalents that can be converted easily to cash. So why has M1 gone haywire? Where is all this cash?

I know that, personally, I have been using almost no cash for an entire year. I can only surmise there are many mattresses around the country that are getting very uncomfortable. Is this OK? Is this telling us we're about to go off the rails? I have no idea, and that's what makes me nervous.

The 2 for 1 Index will continue to be comprised of only exchange-listed equities but I'm thinking most investors, not just old-timers like me, should be much more widely diversified with a weighting favoring capital preservation.

Eight companies that would be eligible for the 2 for 1 Index have announced splits so far this year. From this list we selected Sherman-Williams (SHW) last month.

For March, I'm going with Life Storage Inc. (LSI), a January 3 for 2 split. In LSI we have the 6th largest self-storage REIT, owning over 600 storage facilities and operating an additional 300+ facilities, owned by others, in 30 U.S. states and Ontario, Canada.

LSI's 93% occupancy rate is higher than its peers and supports an impressive cash flow, in addition to the fees earned from its operation of the third-party owned facilities.

Steady growth, a good balance sheet, a safe and growing dividend, and a very low Beta are all numbers to my liking. Another factor, relating to storage REITs in general, is the steady appreciation of their real estate.

Thus, there is often hidden value not shown on the balance sheet. Life Storage, Inc. looks like a good long-term growth prospect and will add some diversity to the 2 for 1 Index. In summary, LSI will be added to the 2-for-1 index.