Water is one of the basic necessities of human life. Life as we know it cannot exist without water. For this simple reason, water may be the most valuable commodity on Earth, notes by Nikolaos Sismanis, contributing editor at Sure Dividend.

Water could be one of the biggest investing themes over the next several decades. An increasing global population is only going to cause demand for water to rise in the future.

And, given the fact that water is a necessity of human life, demand for water should hold up extremely well, even during the worst recessions. Therefore, investors with a longer time horizon should consider water stocks.

These factors make water stocks appealing for risk-averse investors looking for stability from their stock investments. Not all the water stocks on this list receive buy recommendations at this time, as some appear to be overvalued today. But all the water stocks on this list pay dividends and are likely to increase their dividends for many years in the future.

It is only natural for investors to consider purchasing shares of the companies involved in water. There are many different companies that can give investors exposure to the water business, such as water utilities. Some other companies are engaged in water purification. Here are the 5 best water stocks.

Essential Utilities, Inc. (WTRG)

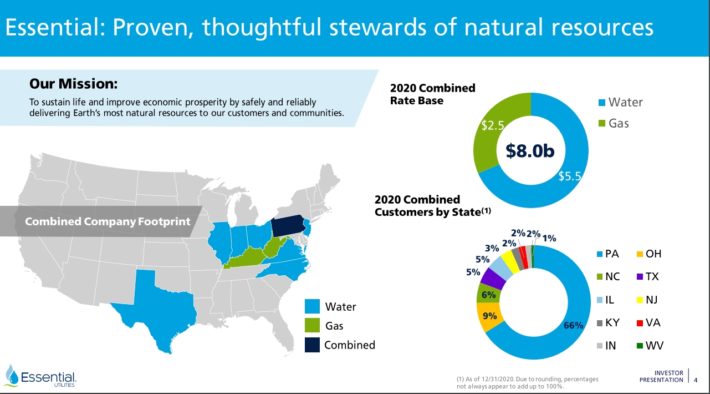

Essential Utilities — with a dividend yield of 2.1% — is the second-largest publicly traded water utility in the U.S., serving approximately 5 million customers across 10 states. The company has raised its dividend for 29 consecutive years.

The company has paid a quarterly dividend for 77 consecutive years. In 2020, which was a year that proved itself to be a challenging one to numerous industries and businesses, Essential Utilities was one of the few that was mostly unaffected from the adverse shocks of COVID-19, with total water usage was up 0.8% YoY.

Source: Investor Presentation

The company has compounded its adjusted earnings-per-share at a CAGR (compound annual growth rate) of 7.4% over the last decade.

We expect the company to keep expanding its bottom line annually at around 7%, on average. Growth will be powered by its recent major acquisition of Peoples, organic growth, and regulated annual rate hikes.

To highlight the company’s focus on growth, Essential Utilities has closed nearly 200 acquisitions and ventures in the last 10 years, buying its smaller competitors and integrating them into its vast network.

Amid a very healthy payout ratio of around 60%, we also expect the company to keep growing its dividend annually at around 7%, similar to its current 5-year average.