Cybersecurity will likely remain a hot issue that the public and private sectors will have to address for some time to come, suggests Jim Woods, fund expert and editor of The Deep Woods.

After a plethora of cybersecurity-related incidents perpetrated by both state and non-state actors around the globe against the United States, Europe and beyond, the importance of cybersecurity defenses and countermeasures in both national and corporate security has been thrust into the limelight.

Cybersecurity stocks previously appeared mainly in exchange-traded funds that are dedicated to technology or software stocks, but ETFMG Prime Cyber Security ETF (HACK) is believed to be the first equal-weighted ETF solely devoted to the growing technology field of cybersecurity.

HACK tracks a tiered and equal-weighted index that targets companies that provide cybersecurity technology and services. The ETF categorizes the companies as developers of hardware or software and providers of cybersecurity services.

Also, while this is an equally weighted fund, HACK’s portfolio is slightly different then the standard definition of “equally-weighted ETF.” Each of the fund’s segments is weighted proportionately by its market capitalization in comparison with the cumulative market capitalization of both segments.

Currently, the fund’s top holdings include Cloudflare Inc. (NET), Cisco Systems Inc. (CSCO), Darktrace PLC (DRKTF), Palo Alto Networks Inc. (PANW), BlackBerry Ltd. (BB), Fortinet Inc. (FTNT), Splunk Inc. (SPLK) and Tenable Holdings Inc. (TENB).

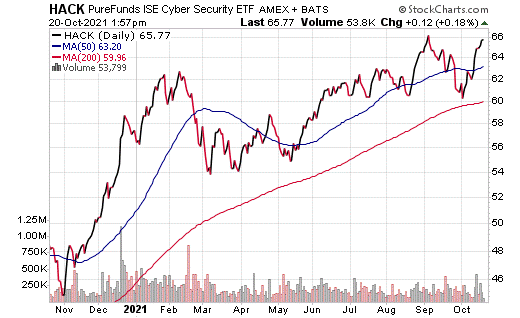

This fund’s performance has been relatively strong, even when including the damage done by the COVID-19 pandemic. As of Oct. 19, HACK has risen 1.66% in the past month and 8.86% for the past three months. It is currently up 14.31% year to date.

Chart courtesy of www.stockcharts.com

The fund has amassed $2.44 billion in assets under management and has an expense ratio of 0.60%. In short, while HACK does provide an investor with a way to profit from cybersecurity stocks, this kind of ETF may not be appropriate for all portfolios.

Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.