As liquidity is drained and capital becomes more discerning, the ability to correctly evaluate “select” businesses is paramount. As opportunity sets improve, the importance of knowing our sweet spots increases, notes money manager Matthew Castel, in the Logos LP Blog.

At its core, our circle of competence includes durable, high-quality (growth security and deliverability) businesses that are trading at reasonable (or cheap) valuations relative to their long-term earnings power. If we are able to develop a deep understanding of these businesses and establish confidence in their long-term business results, we will build meaningful stakes.

No single strategy works in every kind of market yet we believe that long term, having a concentrated portfolio composed of such businesses will offer the best odds of outperformance.

As the Fed moves down a tightening path and elevated market volatility compresses multiples, dislocations are beginning to create attractive opportunity sets in our sphere of competence. One sector in which we are seeing the most attractive opportunity set of relative value per unit of fundamentals is healthcare/life sciences.

At present, the healthcare sector typifies the “quality value” factor trading at a roughly double discount relative to the broader market. This sector offers well above market FCF yield, double digit sales growth and low volatility of sales.

Relative earnings for the sector (vs. other sectors) also appear to be poised for improvement which can support outperformance. This is before considering the secular forces of aging populations, growing demand for health and wellness as well as treatments for complex and chronic diseases.

Such factors also underpin the secular trends currently fueling investment in healthcare sub-sectors including healthcare services, infrastructure, and research globally.

We believe these sub-sectors hold some of the most important innovations of our lifetime, in addition to possessing some of the most durable tailwinds we have seen in a post-Covid world.

According to EvaluatePharma, by 2026, global pharmaceutical R&D spend is expected to reach $233 billion coinciding with US national healthcare expenditures increasing at a 5.5% CAGR between 2019 and 2028.

These secular tailwinds should continue to drive greater demand for diagnostics and novel therapeutics, addressing the world's most complex and onerous disease threats, such as cancer, Alzheimer’s, and other life-altering diseases.

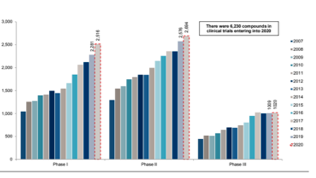

There are currently more compounds in Phases 1-3 of clinical trials than in any other period in history as seen in this chart below:

Additionally, the number of biotech formations and catalysts (these are measured by FDA approvals, audits, readings, or patient output) has declined to 9-year lows due to 1) covid delays; 2) no FDA head for the 9 months prior to October 2021; and 3) fluctuating lockdowns impacting clinical trials.

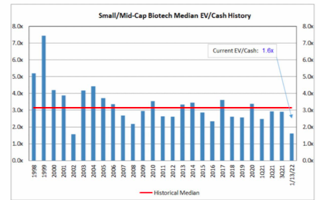

This has led to one of the lowest valuation troughs for the small-to-mid cap biotech sector over the past 20 years as seen below:

This has also led to the longest (and largest) drawdowns for the XBI vs. the SPY in history. Additionally, the biotech sector is well capitalized with high quality assets during a period in which cash rich big pharma will likely look to M&A as they face imminent patent cliffs.

Within the complex described above, we believe the optimal approach is to look at the ‘compounder’ businesses that are less cyclical, possess oligopolistic characteristics, very strong pricing power and are comfortable with share buybacks.

We are currently focusing on a few businesses that meet these criteria including:

1. Charles Rivers Laboratories (CRL) – Provides CRO services to roughly 80% of all FDA approved compounds.

2. West Pharmaceuticals (WST) – Holds 70% market share in drug packaging and has been involved in 90% of all biologics delivery since 2019.

3. Repligen (RGEN) – Has a virtual monopoly on ligand A proteins, a key ingredient for any FDA approved vaccine or therapeutic.

Given the make-up of the economy in a post-Covid world, we believe this rare breed of business is well positioned to take advantage of certain secular tailwinds that will likely be present over the next decade and will provide attractive long-term IRRs.

Furthermore, this view is supported by peaking cyclical growth as well as a slowing pace of earnings growth as 2022 progresses. Slowing growth elsewhere will favor the growth security and deliverability of such businesses in the healthcare/life sciences sector.