Yields are back on the rise again and that may or may not be good news for income seekers, explains exchange-traded fund expert David Dierking, editor of TheStreet's ETF Focus.

If you’re looking to buy into bonds here, the 2.46% yield currently being offered by a 10-year Treasury note is double what it was only back in July of last year. That’s still not near the 4-5% yield that many dividend income investors are trying to generate from their portfolios, but it is the highest it’s been in nearly 3 years.

If you’ve been holding government bonds over the past two years, it’s probably an experience you’d just as soon forget. The iShares U.S. Treasury Bond ETF (GOVT), which invests in a broad range of government bond maturities, is more than 10% off of its highs of August 2020.

If the pitiful yields offered by Treasuries weren’t bad enough, the capital losses shareholders have experienced on top of that are even worse. Investors might want to take a look at other income-producing alternatives. And if we’re looking at alternatives, why not go for the big double-digit yields in the process?

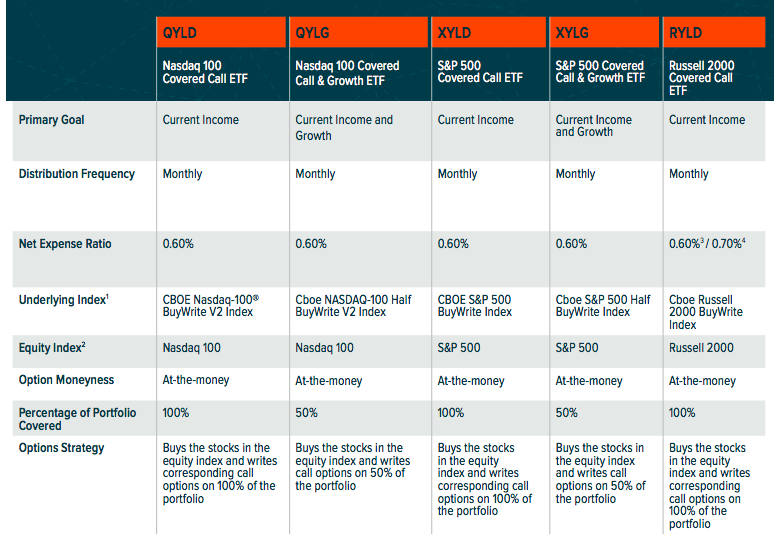

Global X offers a trio of funds that overlay a covered call strategy on top of the major indexes — the Global X S&P 500 Covered Call ETF (XYLD), the Global X Nasdaq 100 Covered Call ETF (QYLD) and the Global X Russell 2000 Covered Call ETF (RYLD).

They sell/write covered call options over the entire portfolio, pocket the option premiums and pay that out to investors in the form of income.

The issuer also offers the Global X Nasdaq 100 Covered Call & Growth ETF (QYLG) and the Global X S&P 500 Covered Call & Growth ETF (XYLG). The difference in these two is that they write options on only half the portfolio.

Covered call ETFs are a great option for those seeking high yields for their portfolios, but they do come with a catch. By writing covered calls, you’re sacrificing capital appreciation upside. The more options that are written, the higher the yield but it also means lower share price growth potential.

The less options coverage, the lower the yield but more share price growth potential. That’s why XYLG and QYLG are called “covered call & growth” ETFs. They offer lower yields, but more growth potential.

QYLD, XYLD and RYLD write options on the entire portfolio, which means maximum yield potential but very little share price growth opportunity. So what kind of yields are we talking about here? Each one is currently paying out roughly a 12% annualized yield.

• Global X S&P 500 Covered Call ETF (XYLD) — 12.0%

• Global X Nasdaq 100 Covered Call ETF (QYLD) — 11.8%

• Global X Russell 2000 Covered Call ETF (RYLD) — 11.9%

Within the framework of these funds, Global X caps the monthly distribution at the lower of a) half of premiums received, or b) 1% of net asset value. Anything above that cap gets reinvested back into the fund, so there is more potential for share price growth here than in other covered call funds.

This is a big part of the reason why we saw the share prices of these funds rise by 25-60% off of their COVID recession lows in 2020. I wouldn’t by any means expect that going forward since that was a very unusual time, but we can see from the current yields that each fund is effectively at or near its cap almost every month right now.

RYLD and QYLD have pretty consistently offered yields of 10% or higher throughout their histories, XYLD had been hovering in the 6-7% range over much of the past three years up until recently. Under calmer market conditions, I’d probably expect yields to start coming back down towards that range again, but income seekers can sure enjoy those higher yields while they last.