I believe right now is the time to be buying municipal bonds with prices beaten down by inflation and rate-hike fears, suggests Rida Morwa, income specialist and editor of High Dividend Opportunities.

Municipals are defensive investments. It is a sector with low defaults, while still providing very reasonable yields. When recession strikes, municipal bonds are a favorite for investors to pour into, making them a defensive investment both from a cash flow standpoint and a price standpoint when tough times hit.

The time has come to make municipals part of our portfolio again. As such, we issued a buy alert — adding BNY Mellon Municipal Bond Infrastructure Fund (DMB) to our portfolio. The fund pays out a monthly dividend of 5.3 cents per share, which it was able to maintain during the COVID crash. That produces a current yield of 5.1%.

DMB has a lot of high credit assets. Just under 39% of its assets are A-rated or higher. Investment-grade assets total 65.6% of its portfolio. Just 0.19% of its assets are rated CCC.

The fund has an emphasis on infrastructure allowing investors to participate in the rebuilding of American roads, bridges, and other infrastructure projects. Many of these bonds have dedicated revenue streams from taxes or tolls. This dedicated revenue adds another layer of safety.

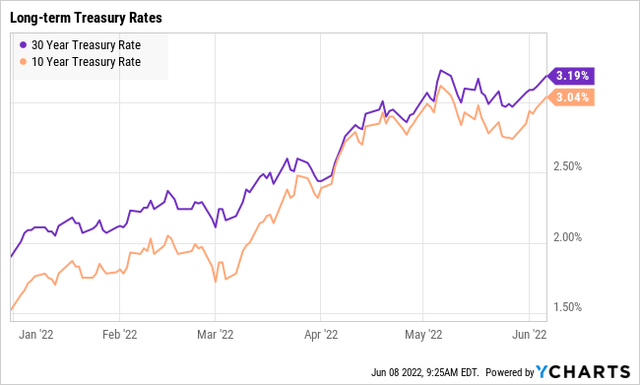

With all debt falling because of interest rate increase expectations, DMB has seen its NAV and price drop. The price has dropped much faster than the NAV. The fund has erased the premium DMB was trading at last year. DMB now trades at a discount of 3%.

DMB has an average effective maturity of 17.61 years. That is quite long and provides DMB with a stable and predictable income, which is passed along to shareholders as dividends. With a very long average maturity, only long-term interest rate trends will impact the ability to pay the dividend.

Note that DMB's portfolio turnover rate is only 11%, which is the portion of the portfolio that is changed over the past year. At only 11%, DMB is primarily buying and holding long-term, not trying to trade in and out.

It's also worth noting that DMB went from trading at a premium to NAV to trading at a discount. This is common for CEFs to "overshoot" in both directions with the price moving more than NAV. This makes CEFs a very compelling opportunity when you believe that bottom is near or has already come in for a sector because the price that overshot to the downside will often overshoot upwards during the recovery.

For those in the 22% bracket, DMB has the same after-tax distribution as a fully taxable investment that yields 6.60% in interest. If you happen to be in the 24% bracket, then DMB pays like a 6.78% investment. And if you happen to be in the 32% bracket, DMB is very attractive with the same after-tax income as a fully taxable 7.57% investment.

Some states will also exempt the income from state taxes, so some investors might get even better benefits. We would never buy an investment solely because of tax benefits, but when a compelling opportunity comes with a favorable tax cherry on top, we aren't going to turn it down!