Don’t sweat energy’s pullback. Take advantage of it with a stock like Energy Transfer LP (ET), suggests Elliott Gue, editor of Energy and Income Advisor.

The S&P Energy Index was recently underwater by 3.6 percent year to date, including dividends. That compared to a return of about 6.5 percent for the S&P 500 and 13.1 percent for the big technology stock-laden Nasdaq 100—something of a reversal from 2022.

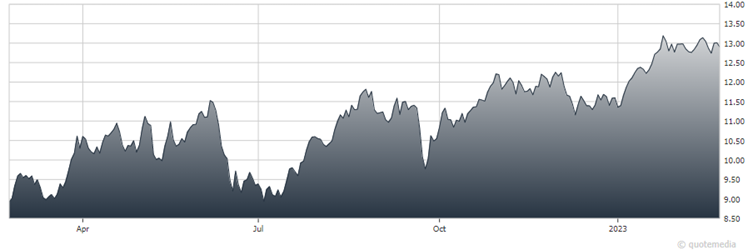

The midstream stock Alerian MLP Index has done well with a 6.7 percent return. And not surprisingly among the leaders is ET, recently up 11 percent after raising its dividend by 15.1 percent—back to what it paid prior to the pandemic as management had promised.

The diversified North American midstream company made good on management’s promise over the past year to boost the dividend to the old level once deleveraging goals were met. We now expect to see more measured annual payout growth going forward, probably in the mid-to-upper single digit percentage range to match the pace of asset expansion.

During the firm’s earnings call, management announced the intention to “balance” future increases against opportunities to cut debt leverage as well as “potential” stock buybacks—though debt reduction is not nearly as urgent as a year ago with net debt to EBITDA within the 4 to 4.5 times target range likely needed to maintain current credit ratings.

A good portion of 2022 growth flowed from the Enable acquisition, followed by new assets coming into service and a surge in US LNG exports. None are likely to have as much impact on 2023, which will put a premium on controlling costs.

But the company still expects to generate almost $4 billion in free cash flow after dividends this year, more than enough to retire all $2.1 billion in maturing debt this year plus at least half the remaining variable rate debt if that’s what management chooses to do. That gives management a lot of options this year to strongly boost shareholder value, and flexibility to deal with and take advantage of whatever happens in the economy and market environment.

And it means minimal risk to the dividend of almost 10 percent. All 19 analysts tracked by Bloomberg Intelligence covering the company rate it buy and insiders continue to increase their holdings. Already up 11 percent year-to-date including dividends, Energy Transfer is a buy up to $15.

Recommended Action: Buy ET up to $15.