After all the recent volatility, the broad market is holding at levels seen before SVB collapsed and triggered the banking crisis. We are recommending Viking Therapeutics (VKTX) based on the company’s recent positive Phase I data, comments John McCamant, editor of The Medical Technology Stock Letter.

Uncertainty continues to plague investors as they fret over the direction of the Fed’s interest-rate hikes, which continue to loom ominously over the markets in the wake of three US bank collapses. The tightrope between the likely tightening in credit over the next few months without tipping the economy into a recession remains a narrow path with little room for error.

But if the Fed finally stops raising rates due to banking concerns, the equity markets should benefit as money rotates out of bonds and back into stocks. This would also be a much better environment for biotechs as their future earnings have been severely discounted in a market dominated by rising rates.

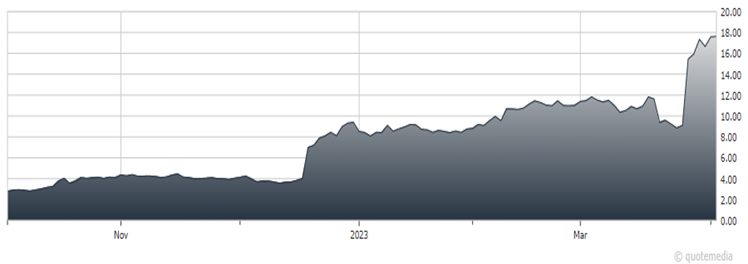

Viking Therapeutics (VKTX)

Now let’s talk about VKTX. The company recently had positive Phase I data for their GLP-1/GIP dual agonist VK2735 in obesity. There is also an expectation that the upcoming Phase IIb due in Q2 for VK-2809 will be positive in NASH.

VK2735 is a novel dual agonist of the glucagon-like peptide 1 (GLP-1) and glucose-dependent insulinotropic polypeptide (GIP) receptors in development for the potential treatment of various metabolic disorders. In our view, ‘2735 has the potential to be best in class, and as good or better than Eli Lilly’s (LLY) tirzepatide (Mounjaro).

We also expect the upcoming Phase IIb trial for their THR-β candidate, VK-2809, in NASH (MRI-PDFF endpoint) to read out positive. This drug candidate is likely to read out positive given the proven mechanism of action, Madrigal Pharmaceuticals’ (MDGL) remtistrom. VK-2735 is the primary reason for our recommendation with its potential to be best in class for obesity.

Recommended Action: Buy VKTX under $21 with a target price of $35.