Worried about a recession? So are countless other investors. Which means it might be “last call” on a bond sale. The flavor-of-choice that has my attention today is Nuveen Municipal Credit Income (NZF), notes Brett Owens, editor of Contrarian Outlook.

I’m pleasantly surprised this deal is still available. U.S. Treasury bonds are receiving a lot of attention as logical recession plays. We know the story well because we started this narrative back in November.

We talked about municipal (“muni”) bonds back then, too. We reasoned that while Uncle Sam’s paper is bulletproof — he owns the global printing press and all — muni bonds were the next best thing.

Well, they haven’t received the love that I’d have anticipated. Treasuries are way up but munis, although they’ve appreciated, are cheaper now than they were then.

We can’t let this opportunity go to waste – which brings me to NZF. Nuveen is our “go to” bond manager when it comes to munis. They get the first phone call and, hence, the best deals.

I’m talking financing for behemoths like Chicago’s Board of Education and New York’s Liberty Development Corp. These state-financed agencies had to pay a bit more than Uncle Sam to borrow, but not much. These are safe because if they ever can’t pay, they will be bailed out by the Fed so they can.

NZF trades at a 14% markdown to its net asset value (NAV). This discount window is as wide open as we ever see.

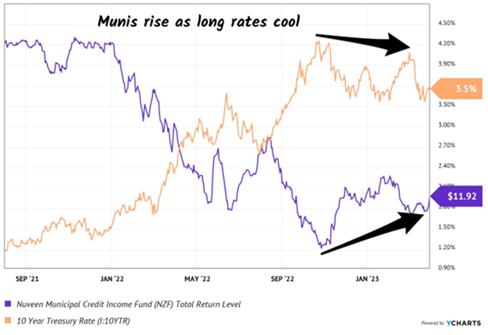

What’s behind the cheap pricing? Munis like NZF have been pinched on both ends by rising rates. First, as long rates rose, the value of NZF’s underlying holdings declined (interest rates up, bond prices down). This was reflected in the fund’s declining NAV.

Second, the earnings power of NZF dropped when its cost of money increased. NZF (like other muni CEFs) uses leverage to juice returns. This is a “no brainer” when short rates are low, but they skyrocketed at the start of 2022.

The result? NZF had to trim its dividend.

But the payout pain appears to be over. Munis are rising and with a recession on the way, a top is likely in for long rates. This will be a net positive for munis:

NZF presents a compelling “total return” formula here. Its dividend will stabilize, and we have a 4.3% starting yield. Plus, the fund is selling at a 14% discount to NAV, which means we can buy it for just 86 cents on the dollar. And its NAV should recover as we head into a recession.

Recommended Action: Buy NZF.