We have spoken about the “wall of worry” the market has been climbing since the June and October lows. The worries never end, but the market should push higher, explains Tom Hayes, founder of Hedge Fund Tips.

“She Had Me at Heads Carolina” is a song co-written and recorded by American country music singer Cole Swindell. The song contains lyrical and melodic references to Jo Dee Messina’s 1996 debut single “Heads Carolina, Tails California”, and credits that song’s writers Mark D. Sanders and Tim Nichols as co-writers. The song peaked at number 16 on the Billboard Hot 100, Swindell’s highest charting appearance to date.

As we have covered in recent weeks, the stock market as a whole is currently at the same levels today as it was 12 months ago AND 24 months ago. But the outlook is more positive.

Like Cole Swindell, it didn’t matter whether they wound up in California or Carolina, the key was they were together. Our view is the market will push higher over time, regardless of the new “worries” that are thrown at it on a daily basis. The “bad news” was priced in last year.

Last month, the market was worried about earnings. They came in better than expected.

Two weeks ago, the market was worried about the Fed. Powell implied he may be at a pause.

Just a few days ago, the market was worried about recession. But the jobs report shot the lights out to the upside.

Last week, the market was worried about high inflation. It came in lower than expected.

This week, we will worry about the debt ceiling. Guess what? They will kick the can down the road and raise the limit.

Meanwhile, in the recent Consumer Price Index report, the most important change was the fact that Shelter/Rent inflation finally PEAKED! We have been saying for months on our podcast/videocast that this would begin and then accelerate in May, June, and July. It happened with the April numbers on Wednesday.

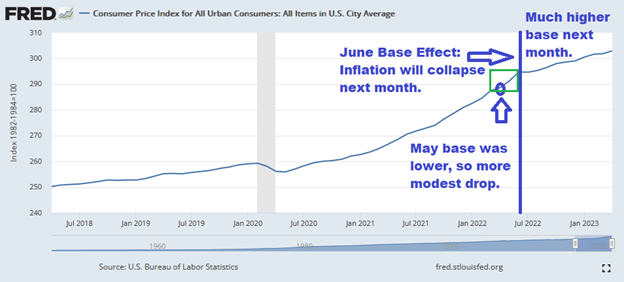

The chart below is the most important in this article. The CPI number was off a low base, which is much lower than the June base will be. So, even if inflation were to run hot at 0.5% MoM, through June, the YoY June inflation number will be ~3.4%.

If inflation runs FLAT, we could see a 2 handle (mid-high 2’s)! This is why I have been saying for months, “watch what happens in the May, June, July inflation reports.”

As for hedge fund positioning, it’s still pessimistic. At levels where “rip your face off” rallies are born, in fact.