There’s an old maxim, “The secret to happiness is low expectations.” This saying could not apply more directly than to what we are seeing coming into the Q2 earnings season. With consensus expectations looking as pessimistic as they were going into Q1 earnings season, the stage is set for another series of positive upside surprises, suggests Tom Hayes, founder of Hedge Fund Tips.

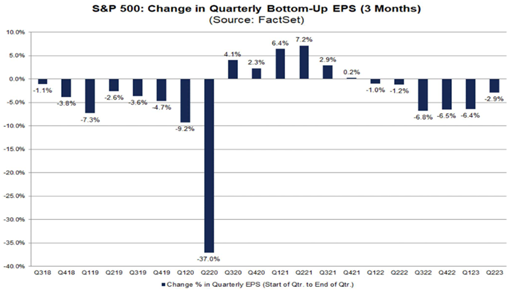

While Q1 earnings expectations were for around -6.6% at the beginning of the season, they finished down only 2% by the end – shattering expectations to the upside and forcing analysts to begin modest upward revisions.

Q2 earnings season – which starts next week – may prove to be a replay of Q1. Set the expectations bar LOW (currently -6.8% estimated) and hop, skip and jump over the very low bar, forcing analysts to panic upgrade and portfolio managers to chase up with leverage.

There is one pocket of the market where expectations are currently set HIGH relative to the market in aggregate (where pessimism prevails). This group is the AI-related stocks and tech/“Magnificent Seven.” They have outperformed in 1H on the basis of these lofty expectations being fulfilled in the near term. But in our view, the likelihood is that this “new industry” emergence will take time.

That does not mean the earnings of the Magnificent Seven will be bad. It simply means we expect the relative outperformance of this group in 2H will pale in comparison to their relative outperformance in 1H. It also doesn’t mean they will do poorly or “crash.” But it is our expectation that the remaining 93% of the S&P will start to catch a bid as managers who missed the gains in 1H start to play “catch up” by buying laggards they have NOT missed.

In Q2, analysts lowered estimates for the quarter by 2.9%. This is lower than the average intra-quarter lowering of 3.4% over the past five years.

The bottom-up target price for the S&P 500 is 4813.70, which is 9.5% above the recent closing price of 4396.44. At the sector level, the Energy (+22.0%) group is expected to see the largest price increase, as this sector has the largest upside difference between the bottom-up target price and the closing price.

On the other hand, the Consumer Discretionary (+4.4%) and Information Technology (+4.8%) sectors are expected to see the smallest price increases, as these two sectors have the smallest upside differences between the bottom-up target price and the closing price.

As we have stated in previous notes and media appearances, besides emerging markets being a major beneficiary of a resumption of the downtrend in the US dollar in 2H, multi-nationals with >50% of their revenues abroad will get have an enormous tailwind moving forward just as they had a headwind in the rear-view mirror.