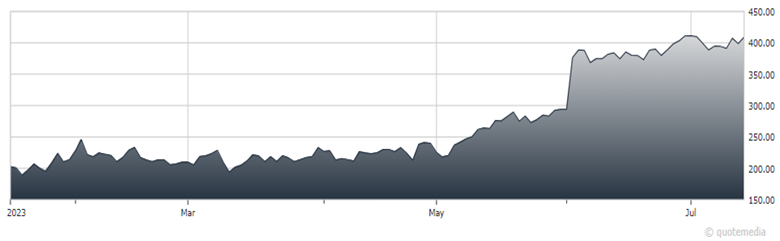

Editor’s Note: Matthew Timpane, senior market strategist at Schaeffer’s Investment Research, had the best-performing recommendation from our annual “Top Picks 2023” Report through mid-year. The software company MongoDB (MDB) produced a total return of 130.8% during the tracked period. I reached out to him recently for updated commentary and guidance on the stock, and this is what he provided...

While there still looks to be potential for bulls to make some profit, I suggest taking at least some of the risk off the table. Leaving a partial position on will give investors potential for more profits, but the market may see a rotation away from tech for the next few months—though once through October expiration, the sector historically comes back to rally.

Of the current market climate for MongoDB, there have only been a few upgrades this year, despite its impressive run. Short interest is down from January, but is basing, and a short-covering rally began in the first half of 2023.

Total estimated revenue growth expanded to 47.1% for 2023, after the company enjoyed a Q1 beat. We can also expect a boost in revenue from generative Artificial Intelligence (AI) due to accelerating application development for new functionality, as big data enters a new paradigm shift.

MongoDB (MDB)

The stock is still sporting an elevated Schaeffer’s Volatility Scorecard (SVS) of 94 (out of 100). Even further, at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), MDB sports a 50-day put/call open interest ratio of 1.36, which ranks in the 98th annual percentile. In simpler terms, should this bearish sentiment begin to unwind, it could trigger further tailwinds for the software giant.

However, like we mentioned earlier, risk remains, with potential for macro headwinds. To alleviate unnecessary risk, it’s suggested to cut any remaining position if the stock breaks below the 200-day moving average.

Recommended Action: Buy MDB.