Gas utilities consist of companies that provide distribution services to residential, commercial, and industrial customers. These services include pipeline transmission, distribution, and delivery of gas for heating and cooking. Atmos Energy (ATO) is one that climbed into the top spot of my “Best Buys” list recently, writes Robert Rapier, editor of Utility Forecaster.

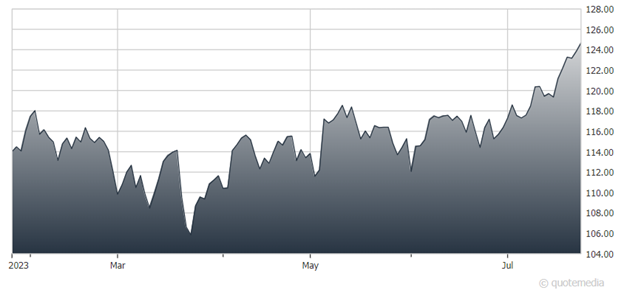

While gas utilities haven’t fared well over the past year, Atmos has bucked that trend, notching a positive return year-to-date and over the past 12 months. It was only one of two natural gas utilities to notch a positive return over the past year.

The natural gas utility sector’s performance is influenced by the overall economic climate. When the economy is doing well, businesses and industries consume more natural gas, especially when there is growth in the economy and an increase in housing construction. However, if the economy weakens, industrial and commercial customers may reduce their natural gas consumption.

The profitability of natural gas utilities depends on the season. During winter, the demand for natural gas rises because of heating needs, while in summer, it increases due to electricity demand for air conditioning. Unusual weather conditions can cause fluctuations in earnings. Some states have mechanisms in place to protect consumers from high prices resulting from weather events. However, these mechanisms can have a negative impact on short-term profits.

Atmos Energy (ATO)

While Fidelity is neutral on the sector overall, Atmos is rated as “Bullish” by the firm. FactSet also ranks Atmos as the third best company in the group. The two it ranked ahead of Atmos are both very small companies.

Keep in mind that natural gas stocks offer low volatility, high price stability (usually), better-than-average earnings predictability, and strong financial health. They provide attractive dividend payouts, and their share prices tend to hold up well during economic downturns compared to other sectors.

Overall, natural gas utilities represent a fairly low-risk, stable industry with the potential to deliver moderate but consistent total returns from both dividends and share price appreciation. For income investors, gas utilities should continue to be a good income option for many years to come.

Recommended Action: Buy ATO.