Even though they are as boring as companies get, utilities are one of the most valuable sectors for income investors, asserts Rida Morwa, income expert and editor of High Dividend Opportunities.

These companies provide essential services such as electricity, water, and natural gas, fundamental to our everyday lives and business operations. The demand for these services remains unaffected through economic cycles, and the companies often operate under a regulated framework that provides a level of stability and predictable revenue streams.

While individual utility companies pay dependable dividends and enjoy regulatory protection for their profit margins, they operate more regionally, and their operations are vulnerable to weather patterns, cyber attacks, and natural disasters. We like this industry for its moat, regulatory protections, and inelastic demand.

Reaves Utility Income Trust (UTG) offers investors a suitable method of drawing benefits from this sector while collecting sizable monthly income. The closed-end fund is diversified across 44 companies, primarily in the U.S. and Canada, and a small yet notable participation from Germany and Italy.

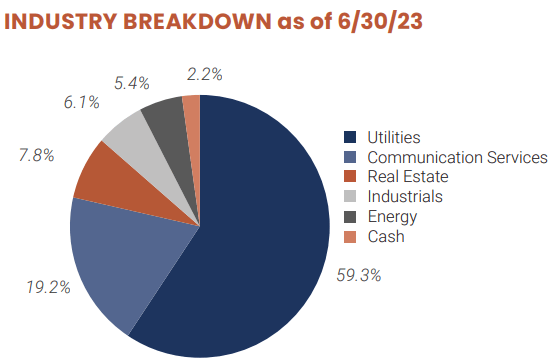

Some 80% of the CEF is built with companies that are the largest and most prominent in their field, with utility and communication services companies, and there is modest exposure to infrastructure REITs like Digital Realty Trust (DLR), Equinix (EQIX), and American Tower (AMT).

UTG trades at par with NAV, presenting an excellent opportunity to initiate/add to your income portfolio. The CEF pays $0.19/share, a solid 8.1% yield, with a stellar track record of distribution raises and special payments since its inception in 2004.

Built primarily with the recession-resistant utility sector, UTG has kept its distribution even during the darkest days of the Great Financial Crisis or the COVID-19 crash. UTG is modestly leveraged at 20% of net assets. As of April 30, the portfolio carried $515 million in borrowing from credit agreements at a weighted average interest rate of 4.99%.

There has been some concern about UTG’s distribution sustainability. Year-to-date, UTG’s distributions have been 69% capital gains (primarily long-term) and 31% net investment income. In its semi-annual report, UTG reported $146.9 million (almost $1.96/share) in unrealized gains as of April 2023, positioning the fund well for distribution sustainability for the foreseeable future.

Markets rarely go in a straight upward or downward direction. There is a healthy mix of rallies and declines, and UTG has actively managed to change its allocations, take advantage of the movements, and generate cash returns for shareholders. Recent price levels provide a sizable 8.1% annualized yield from a robust and resilient sector to brace yourself for the upcoming recession.