So, after all the hype, all the analysis, and all the angst – what did the CPI do? Well, it was up. It was up on the top line and it was up when you take out all the volatile elements like food and energy. But the hotter CPI figure did little to rattle investors and they seem good with the notion that the Fed is holding rates steady in September, explains Kenny Polcari, Chief Market Strategist at SlateStone Wealth.

Of course, if you take all the CPI elements out, guess what it would be? Zero! Amazing how that works, no? Then we would have no inflation, nothing to worry about. So, why don’t they just create a new category and call it the CPI of nothing...problem solved!

In any event, let’s be serious. The stuff you don’t need every day to survive is seeing some price relief, but the stuff you do need every day to survive is not seeing any relief. Inflation in those sectors remains ‘sticky’ (think food, energy, utilities, healthcare). But – as discussed recently – they want you to focus on the EX-category.

As for the Federal Reserve, it appears as if the September FOMC meeting is in the books: Rates to remain steady, no hike. And the November meeting? Well, that’s still 50/50...and December appears to be below 10%.

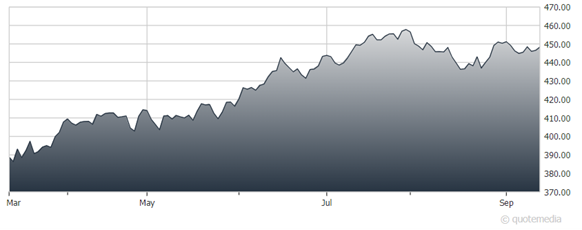

S&P 500 ETF Trust (SPY)

So, maybe this is the peak? Could that be possible? For today it is, but I wouldn’t go betting the ranch on that. At least not YET. That doesn’t mean get out. It just means proceed with caution because my sense is that the ‘sticky part’ will remain ‘sticky’ and that is going to cause the Fed to do one of two things:

1. Go back to raising rates

OR

2. Accept it and then move its inflation target from 2% to 3%.

Now if they go back to raising rates, then we can see bond yields jump to 4.5% in the 10-year and something like 5.2% for the 2-year. If they choose to raise the acceptable inflation rate (and do nothing on rates), then I think bonds will settle in here: 4.3% on the 10 yr. and 5% on the 2 yr. Shorter-duration bonds will remain yielding 5.5%.

That will continue to be a headwind for stocks – for now. What has to happen is that investors now have to get used to the new paradigm. Longer term, the S&P ended the CPI day at 4,467, up six points. We remain below trendline resistance, and I continue to believe that will be the case until we enter earnings season.

I think investors are tiring a bit, and while I expect some near-term weakness, I am not expecting a big selloff. I think we end the year around 4,500 on the S&P.